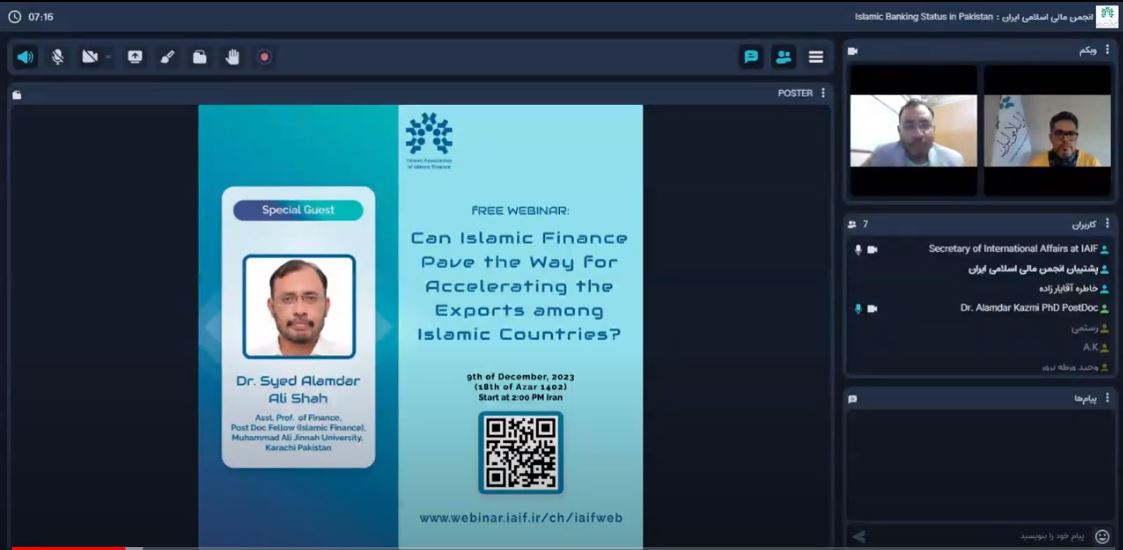

The Iranian Association of Islamic Finance (IAIF) helds an international webinar on the role of Islamic finance in accelerating exports among Islamic countries.

The Iranian Association of Islamic Finance held an international webinar on “How Islamic Finance Can Pave the Way for Accelerating the Exports among Islamic Countries” on the 9th of December at 2 PM Iran time.

Speaker:

Dr. Syed Alamdar Ali Shah,

Assistant Professor of Finance, Department of Management Sciences Muhammad Ali Jinnah University,

Karachi, Pakistan.

PostDoc Fellow (Islamic Fintech)

PostDoc Fellow (Sustainable Islamic Finance)

PostDoc Fellow (Islamic Finance)

PhD (Hons) (Islamic Finance & Capital Markets)

Absolutely! Islamic financing can play a significant role in boosting exports among Islamic countries.

Islamic Finance is actually an Islamic Finance revolution

Referring to the development and widespread adoption of Islamic banking it is appropriate to term Islamic finance as an "Islamic Finance revolution".

Industrial revolution Vs Islamic Finance revolution

Drawing parallels between the Industrial Revolution of the 19th century and the Islamic finance revolution of the 21st century involves considering their respective impacts on economic, social, and financial landscapes. Here are some points of comparison:

• Transformation of Economic Systems

• Technological and Institutional Changes

• Impact on Trade and Commerce

• Social and Cultural Changes

. Globalization and Connectivity

How Islamic finance can help in promoting exports

Islamic finance encompasses principles and concepts that can contribute to the promotion of exports among Islamic countries. Here are some key areas that are relevant to fostering international trade:

• Ethical Trade Practices

• Zakat and Charity

• Wealth Distribution

• Islamic Social Financing

• Interest-Free Banking

• Sharia-Compliant Business Contracts

• Islamic Economic Cooperation

Microeconomic perspective for promoting Exports

Islamic finance microeconomics perspective focuses on individual economic agents, households, and small businesses within the framework of Islamic principles. Here are some key areas within Islamic microeconomics that can contribute to the acceleration of exports among Islamic countries:

Islamic Microfinance

• Entrepreneurship Development

• Islamic Social Entrepreneurship

• Fair Labor Practices

• Islamic Consumer Behavior

• Halal Industry Development

• Qard al-Hasan (Benevolent Loans)

• Islamic Work Ethics

Islamic microeconomics, countries can create a supportive ecosystem for individuals and small businesses engaged in export activities. This, in turn, contributes to the overall economic development and sustainability of export-oriented initiatives within Islamic nations.

Islamic finance macroeconomic perspective focuses on the broader economic conditions, policies, and structures within a country or region, guided by Islamic principles. Here are some key areas within Islamic macroeconomics that can play a role in accelerating exports among Islamic countries:

• Islamic Fiscal Policy

• Islamic Monetary Policy

• Islamic Economic Planning

• Islamic Banking and Finance Infrastructure

• Zakat Utilization for Economic Development

• Islamic Trade Policies

• Islamic Economic Cooperation and Integration

• Islamic Social Safety Nets

• Environmental Sustainability

Integrating environmental sustainability into economic policies aligns with Islamic principles of stewardship over the Earth. Export-oriented industries can be encouraged to adopt eco-friendly practices, contributing to sustainable economic growth.

Islamic monetarist perspective for promoting Exports

Promoting exports among Islamic countries from an Islamic monetarist perspective involves aligning monetary policies with Islamic principles to create a conducive economic environment. Here are some strategies:

• Interest-Free Financing

• Stable Money Supply

• Islamic Financial Instruments

• Trade Finance Based on Sharia Principles

• Islamic Foreign Exchange Markets

• Islamic Monetary Cooperation

• Encouraging Islamic Trade and Investment

• Zakat Utilization for Economic Development

• Strengthening Islamic Banking Infrastructure

• Financial Inclusion for Exporters

By aligning monetary policies with Islamic principles and fostering a supportive financial environment, Islamic countries can create conditions that promote exports in a manner consistent with Islamic monetarist perspectives. This approach emphasizes ethical and interest-free financial practices, contributing to a sustainable and inclusive economic system.

Fiscal perspective for promoting Exports

From an Islamic fiscal perspective, implementing measures that align with Islamic principles can contribute to the promotion of exports among Islamic countries. Here are key measures to consider:

Equitable Taxation:

Zakat Utilization for Economic Development:

Islamic Development Funds:

Public-Private Partnerships (PPPs):

Ethical Public Expenditure:

Support for Halal Industry:

Islamic Social Spending:

Islamic Sovereign Wealth Funds:

Islamic Trade Policies:

Waiver of Unjust Tariffs:

Qard al-Hasan (Benevolent Loans):

By adopting these measures, Islamic countries can create a fiscal environment that supports ethical, inclusive, and sustainable economic development, ultimately contributing to the acceleration of exports in alignment with Islamic fiscal principles.

Classical and neoclassical Islamic Economic perspective for promoting Exports

While the classical and neoclassical economic perspectives are not specific to Islamic economics, some principles can be adapted to promote exports in alignment with Islamic values. Here are ways to promote exports from both classical and neoclassical Islamic perspectives:

Classical Islamic Economics Perspective:

• Trade as Ethical Exchange

• Mutual Cooperation

• Avoiding Exploitation

Neoclassical Islamic Economics Perspective:

1. Market Efficiency

2. Incentives for Exporters

3. Market-oriented Policies

4. Supply and Demand Dynamics

5. Investment in Human Capital.

6. Infrastructure Development

7. Trade Liberalization

8. Foreign Direct Investment (FDI)

9. Price Mechanism

10. Resource Allocation Efficiency

While the classical and neoclassical economic perspectives are not specific to Islamic economics, some principles can be adapted to promote exports in alignment with Islamic values. Here are ways to promote exports from both classical and neoclassical Islamic perspectives:

Classical Islamic Economics Perspective:

• Trade as Ethical Exchange

• Mutual Cooperation

• Avoiding Exploitation

Neoclassical Islamic Economics Perspective:

1. Market Efficiency

2. Incentives for Exporters

3. Market-oriented Policies

4. Supply and Demand Dynamics

5. Investment in Human Capital.

6. Infrastructure Development

7. Trade Liberalization

8. Foreign Direct Investment (FDI)

9. Price Mechanism

10. Resource Allocation Efficiency

Financial Stability of Islamic Financial Systems

Maintaining Islamic financial stability is crucial for fostering economic growth and supporting exports among Islamic countries. Here are some key areas within Islamic financial stability that can contribute to the acceleration of exports:

• Islamic Banking Resilience

• Risk-Sharing Mechanisms

• Stable Islamic Capital Markets

• Liquidity Management

• Sharia-Compliant Financial Instruments

• Islamic Insurance (Takaful)

• Regulatory Frameworks for Financial Stability

• Islamic Financial Inclusion

• Cross-Border Financial Cooperation

By focusing on these areas and promoting financial stability within the Islamic financial system, countries can create a solid foundation for businesses engaged in exports. This, in turn, contributes to sustained economic growth and development in accordance with Islamic principles