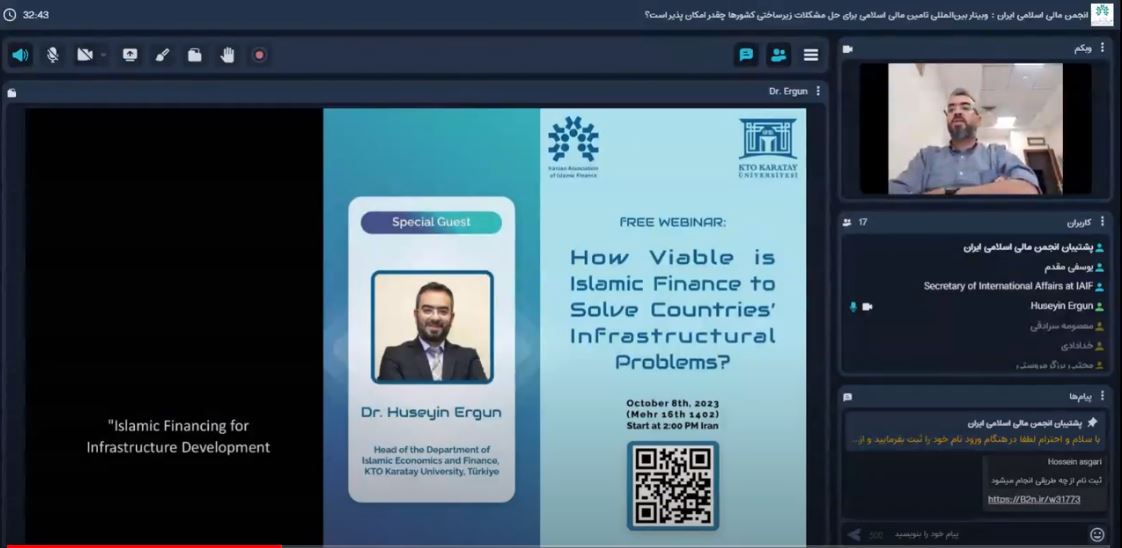

The Iranian Association of Islamic Finance held an international webinar on “How Viable is Islamic Finance to Solve Countries’ Infrastructural Problems" on 8th of October, 2023.

The Iranian Association of Islamic Finance held an international webinar on “How Viable is Islamic Finance to Solve Countries’ Infrastructural Problems” on 8th of October, 2023 at 2:00 PM Iran time.

Speaker:

Dr. Huseyin Ergun, Head of the Department of Islamic Economics and Finance, KTO Karatay University, Turkiye

To explore the viability of Islamic financing in addressing infrastructure challenges we need to consider the following issues:

Ethical and Shariah Compliance, Contract, Risk Sharin, Long-term sustainability, Inclusivity, Infrastructure Sukuk, Local Investment and Development, Regulatory Support, Collaborations, Challenges, Sustainable Development Goals, Future Trends, Innovation.

The features of infrastructure projects:

Large, Lumpy, Indivisible

Capital intensive with high sunk costs

Long gestation period

Natural monopoly characteristics

Public good characteristics

Non-tradability of output

Large externalities

Interconnected network systems

The Way Forward

• Entering into sales and purchase transactions

• Entering into leasing arrangements

• Participating in equity investments.

• While applying Islamic finance instruments to infrastructure PPP projects, financiers need to enter any or a combination of these three transactions, at the same time creating a structure that aligns with the conventional debt or equity structure.

• The former ensures compliance with shari‘ah requirements.

• The latter conforms to the existing financing frameworks that are being used to finance infrastructure PPP projects, thus allowing Islamic finance to seamlessly integrate with the rest of the capital providers coming from conventional sources.

Stages of the Development of a project:

• Design: Preparing the developing project plan in terms of initial concept, input and output requirements for construction. In this planning stage, the details of project assets and how they will be financed will be delineated.

• Build or Rehabilitate: Greenfield projects would involve building new assets and brownfield projects would rehabilitate existing assets.

• Finance: Depending on the contractual arrangements, the private sector has to finance all or part of the costs of building or rehabilitating projects.

• Maintain: The infrastructure assets have long lives and have to be maintained. The role of the private sector in the maintenance of the assets will be specified in the contract.

• Operate: Depending on the nature of infrastructure assets and the services produced, the contracts will determine the role of the private sector in operating the infrastructure projects. Types of contractual arrangements may involve the following: technical operation of the project and the provision of services to a government-related off-taker; technical operation of the project and the provision of services to direct users; and the provision of support services for operations with the government offering services to the end-users.

Infrastructure projects:

• Fully self-sustainable projects: This category of infrastructure includes those that can generate revenue that not only covers the costs of investments but also yields profits to the sponsors over the project’s operational life. Examples of infrastructure that fall in this category are power, energy, telecommunications and highway projects that can generate high toll-revenues.

• Partially self-sustainable projects: The revenue of these projects comes from tariffs and fees paid by end-users that are controlled by the government. The prices are set on the goods and services and are not high enough due to public welfare reasons. Since the relatively lower prices and revenues make the projects unprofitable, the private sector engages in these infrastructure projects if supported by other remedial options such as grants, tax breaks or subsidies. The sectors that fall in this category include railways, urban light rails, water and sewerage.

• Financially unsustainable projects: This type of infrastructure does not generate any revenue and, as such, is usually provided by the public sector. The social infrastructure such as schools, hospitals and public housing fall in this category. The private sector can be involved in the construction of the facilities and would be paid by the government accordingly.

Modes of Infrastructure Finance:

1: Equity

• Two categories of equity investment that represent ownership interests can be identified in infrastructure projects.

• The first kind is unlisted equity provided by the project sponsors who may be infrastructure management companies, project developers, private equity funds, construction, and engineering companies who establish the project company in the form of an SPV and provide the initial capital for an infrastructure project. Being project shareholders, they take the risk of residual losses of the project.

• The second type is listed equity that raises funds from the market that are used in infrastructure projects. Examples of instruments in this category include listed infrastructure equity funds, utilities stocks, and other funds such as real estate investment trusts (REITs). A key distinguishing feature of the two types of equity is that, in the latter, the ownership interests can be sold on the market, something which cannot be done in case of unlisted equity.

2: Debt

• The goal of the project company is to use a finance structure that minimizes the overall costs of the project. The finance costs are reduced by taking on debt since equity is more costly than debt. Thus, debt constitutes a significant part of project financing. There are estimates that the debt component of project financing can be in the range of 70% to 95% of the total. Higher leverage, however, increases the risks and, as such, can increase the cost of borrowing. Thus, from a public-policy perspective, the procuring authority has to ensure that the project company is adequately capitalized.

3: Hybrid

• The hybrid instruments can include various structures and offer investors varied risk-return investment profiles. Forms of hybrid instruments can include convertible bonds, preferred shares or mezzanine financing. Convertible bonds represent junior claims relative to other debt instruments and have the option of being converted into equity. While they provide protection against downside, investors can benefit from the upside of a growing concern by opting to convert bonds into equity. Due to the option of conversion, the coupon rates paid are usually lower than other forms of debt. Preferred equity is usually with perpetual instruments with debt-like features that can be issued by listed companies. Preferred stock holders have claims to missed dividends and do not dilute ownership. While the investors are subordinated to other debtors, they have priority in claims relative to the common stock holders. Mezzanine financing takes the form of subordinated debt that can take the form of a loan or a bond. Since the risks are higher, mezzanine debt provides yields that lie between senior debt and equity.

ISLAMIC FINANCE INSTRUMENTS

There are several building blocks, or basic Islamic finance instruments, that Islamic financiers deploy when entering into PPP infrastructure transactions, such as IJĀRAH (LEASING), MURĀBAHAH, ISTISNĀ, MUSHĀRAKAH, MUDĀRABAH, SUKŪK (INVESTMENT CERTIFICATES), TAKĀFUL (INSURANCE).

It is important to understand the rationale behind the agency agreement and the service agency agreement. Islamic financiers are essentially financial institutions. It is neither their business nor expertise to physically procure assets and maintain those by themselves. Through these two agreements, Islamic financiers delegate these roles, which are supposed to be performed by the lessor, to the lessee.

Features of Infrastructure PPP Projects:

* Infrastructure PPP projects allow risk to be shared among the parties involved in the project, including financiers.

* PPP projects allow Islamic financiers to become a party to the project, not just a mere lender.

* Infrastructure PPP projects are by nature free from speculation or gambling.

*Project contracts are generally well defined with no uncertainty.