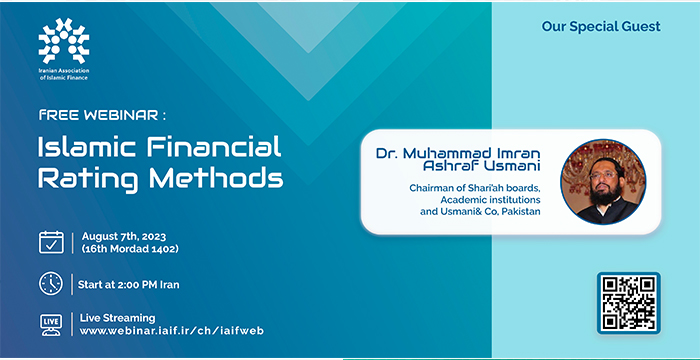

The Iranian Association of Islamic Finance held an international webinar on Islamic Financial Rating Methods on August 7th, 2023.

Speaker:

Dr. Muhammad Imran Ashraf Usmani,

Chairman of Shari’ah boards, Academic Institutions and Usmani & Co, Pakistan

Delving into the world of Islamic finance: Exploring the nuances of Shari’ah compliance and credit ratings.

Dr. Usmani said our journey begins with an insightful article that paves the way towards establishing comprehensive guidelines for Shari’ah compliance ratings in Islamic banking institutions. With guidance from respected scholars and institutions like Mufti Muhammad Taqi Usmani and the International Islamic Rating Agency (IIRA), we're on a mission to refine the assessment of financial practices.

However I tried to write an article to research what should be guidelines to do Shari’ah ratings for Islamic banking institutions. I showed that to my honorable father (Mohamad Taghi Usmani) he appreciated it and told, this article can be a starting point to work on these lines.

Then he pointed out to the principles of Islamic banking, saying avoiding Riba, Gharar, and Maysir are the base of Islamic banking.

Shariah standards are set by Accounting and Auditing Organization of Islamic Financial Institutions (AAOIFI), moreover, the role of a proper Shariah Supervisory Board and Shariah Advisor in guiding daily transactions and ensuring compliance is highly significant.

As to the importance of Mudarabah and Musharakah, Usmani mentioned Mudarabah and Musharakah as partnership-based financing modes and their significance is to promote profit-sharing and risk-sharing.

Their usage is on both liabilities (deposit) and asset (financing) sides, especially with corporates for higher returns and low risk.

Regarding the challenges with Mudarabah and Musharakah in SME Financing, Dr. Ashraf Usmani stated the challenges Islamic banks face when using Mudarabah and Musharakah for SME financing, could be higher risk exposure, so the preference for secured financing methods like Murabaha, Ijarah, Salam, and Istisnaa could be more due to protecting depositors' funds.

He went on to say that the having trained staff can lead to satisfied clients and increase in the bank's reputation as a Shariah-compliant institution, furthermore, the importance of clear and comprehensive disclosure of terms and conditions can build trust with customers.

In the end, Dr. Muhammad Imran Ashraf Usmani deception and the lack of transparency can negatively impact the Shariah compliance rating.