REDmoney has published Hassan Ban's latest article on Shariah Compliant Regtech Beyond Self-Regulated Ecosystems.

By Hassan Baan, Member of International Committee at IAIF

Can the centralized Shariah committees of Islamic financial institutions which can only rule in the limitation of their respective country borders fulfill the financial needs of Muslims around the world? The answer is clearly a ‘NO’, hence the need for a new business model for Shariah committees of the Islamic financial institutions.

Achieving regulatory compliance in a digital world results to the rise of regulatory technology (regtech) in the global financial institutions, but what about Islamic financial institutions in the case of Shariah compliance?

Nowadays Islamic regtech is more than a catchword that is already having an impact on regulatory compliance. It is not about regulatory reporting, risk management, identity management & control or transaction monitoring but a solution for Shariah compliance that includes real time monitoring and tracking of current state of Shariah compliance and upcoming regulations in Islamic banks and Fintech platforms. The current centralized pyramid structure of Islamic financial institutions and the passive role of Shariah committees could not fulfill the Shariah compliant needs.

The Islamic RegTech is a solution for:

1. Shariah regulatory reporting through big data analytics,

2. Real time Shariah reporting and cloud,

3. Detect Shariah compliance and regulatory risks,

4. Assess halal/haram risk exposure,

5. Anticipate future threats in trades and finance,

6. Facilitate counterparty due diligence across the Islamic world,

7. Know-your-customer (KYC) procedures, including conditions like age, understanding (Aql) and so on.

8. Solutions for real time transaction monitoring, and

9. Auditing especially when we trade across two parties from different Mazhab (school of Islamic thoughts).

These aims are possible, but not through the current scheme of isolated Islamic banking and finance in the MENA or the South East Asia regions. It can be made possible by leveraging the benefits of distributed ledgers through blockchain technology and cryptocurrency in countries with majority or even minority Muslims. The first and the most important is scaling up the Shariah committees.

Compliance in centralized and decentralized ecosystems

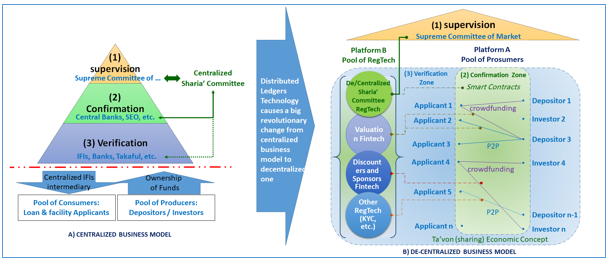

Diagram 1, left-hand side, shows a common Islamic financial institution and its customers outside its structure. With some regulation Islamic financial institutions provides financial services to their customers, like the structure of other conventional financial institutions. Compliance will be catch up in their board of director level, or even in supervisory authority institutions (such as central banks or SEC of the country). This old fashioned business model of work could not be able to scale up beyond the borders unless using Fintech as its channel of connection to the new customers, the famous one in this model is an Islamic Fintech by name of Insha in Europe. Other cases are Investment Account Platform in Malaysia or Shariah Online Trading System (SOTS) in Indonesia, and both using centralized Shariah committee, which causes them to be not agile and not able to scale up.

Diagram 1: Centralized Islamic finance institutions and decentralized Islamic finance ecosystem

Source: Author’s own

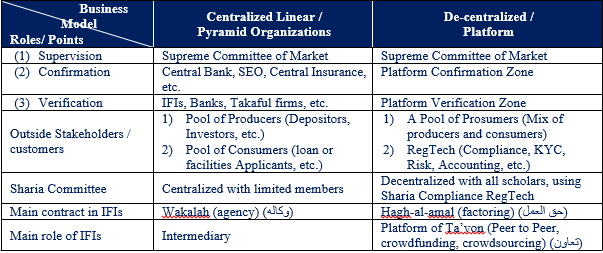

In both models, there are three pillars in "Financial Market Design" those are (1) Supervision, (2) Confirmation and (3) Verification, hence the targeted point of effect in "sharia committee" inside the market has been changed in this two models. Other different between two business models is listed in table 1.

Table 1 differnce of centralized and decentralized business models in IFIs

Diagram 1, right-hand side, consists of a decentralized Islamic finance ecosystem. In the decentralized business model, members of society of the Islamic ecosystem play a role in verifying and/or confirming a transaction or a report, such as credit report for Islamically approved financial services. In other hand, all scholars (included Islamic Scholars, Chartered, Professionals, etc.) have access to the market through Regtech.

In other words, Stakeholders (RegTech and Prosumers) in both platforms in diagram 1 has two tasks: Verification & Confirmation and they receive intensive for their task. Also, Stakeholders in both platforms in diagram 1 has two roles: Producers of funds (depositors and or Investors) & Consumers of funds (Loan or facilities applicant). Based on some regulations (indicated in Smart Contracts), the platform provides financial services through its stakeholders, but the question is who approves its services as Islamic or non-Islamic?

Firstly, the new business model of Islamic finance, that is significantly matched by Ta’von terms, an economic Islamic term, like crowdfunding and/or crowdsourcing, is not based on ownership of assets in the balance sheet of Islamic financial institutions. There is also no simple Wakalah contract between the Islamic financial institution and its customers, as this is common in centralized business models.

Business model that is based on a special Wakalah contract, called "fee-for-service" or "factoring" has no assets in the balance sheet of the modern Islamic financial platforms.

Secondly, the centralized business model in Diagram 1 will sooner or later be transited to the distributed ledgers of the Islamic finance platform. So there is no implemented committee in this platform, and all committees such as supervisory, auditing, compliance and such, will be outsourced to the RegTech companies including Islamic RegTech (modern Shariah compliant committees). The de-centralized business model could easily scale-up its services to all Muslims based on Shariah thoughts and Madhab.

What is decentralized Shariah committee based on distributed ledgers?

As a case, Resalat Qard-al-Hassan Bank in Iran worked on decentralizing its business model in the last six years so as to play a role as a social platform bank by first switching to a decentralized bank and then upgrading to a fully decentralized distributed ledger. In this case, the bank only focused on one Islamic finance service that is Qard Hassan, so it was initially approved. By this, its Shariah committee has been simplified.

Shariah compliant RegTech can be defined in two business models for:

modern digital banking (such as platform and virtual banking);

investments (combination of debt and equity financing) in modern Ta’von (Peer to Peer, crowdsourcing and crowdfunding) platforms.

Ta’von, an economic concept similar to sharing economy, includes two sectors (a) social Ta’von — crowd sourcing and (b) economical Ta’von — crowd funding. Before the 2010 technology revolution, all financial institutions played intermediary roles in sharing economy and after 2010, the concept of Ta’von was implemented without any intermediaries.

The implementation of the above two Shariah compliant RegTech models require the application of the following to achieve Shariah compliancy and Shariah control before and after signing contracts between stakeholders:

• smart contract and blockchain for Shariah compliant RegTech (crowd-wisdom, in both linear and decentralized private ledgers),

• calculation

• reminders

• allocation of Zakat

• differentiating between commonly used regulation from others by smart filtering or artificial intelligence

Conclusion

As we are stepping into the third millennium along with the digital revolution, new business models of Shariah supervisory are needed. Since the current models of the Islamic financial institutions will be upgraded to decentralized ones, it is the right time for the Muslim society (Ummah) to receive reassuring measures from Shariah scholars in their daily digital e-commerce. This is the best time to change and switch the power from the hands of a minority in the Shariah committees to the hands of the majority of scholars. The only available instrument to de-centralize the Shariah committee is to implement blockchain through wisdom of the crowd among Shariah scholars.

Hassan Baan is the CEO of Melkbama, an Iranian Proptech Fintech (Islamic). He can be contacted at This email address is being protected from spambots. You need JavaScript enabled to view it. and LinkedIn. https://www.linkedin.com/in/hsnbaan/