IAIF held a specialized session on “The interaction of Islamic financial markets in order to curb inflation and production growth”.

IAIF held the session on the 13 of February, 2024. Dr. Gholamhossein Taghi Netaj, a member of the Islamic Financial Management Department of Imam Hossein University (AS), Dr. Mohammad Selgi, Director of the Islamic Financial Management Department of Imam Hussein University (AS), Dr. Hossein Fahimi, an expert in financial markets, Dr. Hamid Mortezania, a member of the Islamic Financial Management Department of Imam Hussein University (AS) and Dr. Ali Islamjo, a member of the Islamic Financial Management Department of Imam Hussein University (AS)were the speakers of the session.

Dr. Fahimi said that the challenge of inflation is not limited to our economy and some other countries such as Turkey are also facing it. In Turkey, the intensity of inflation sometimes exceeds ours while its economy is not damaged by sanctions., but it has faced inflation and production challenges.

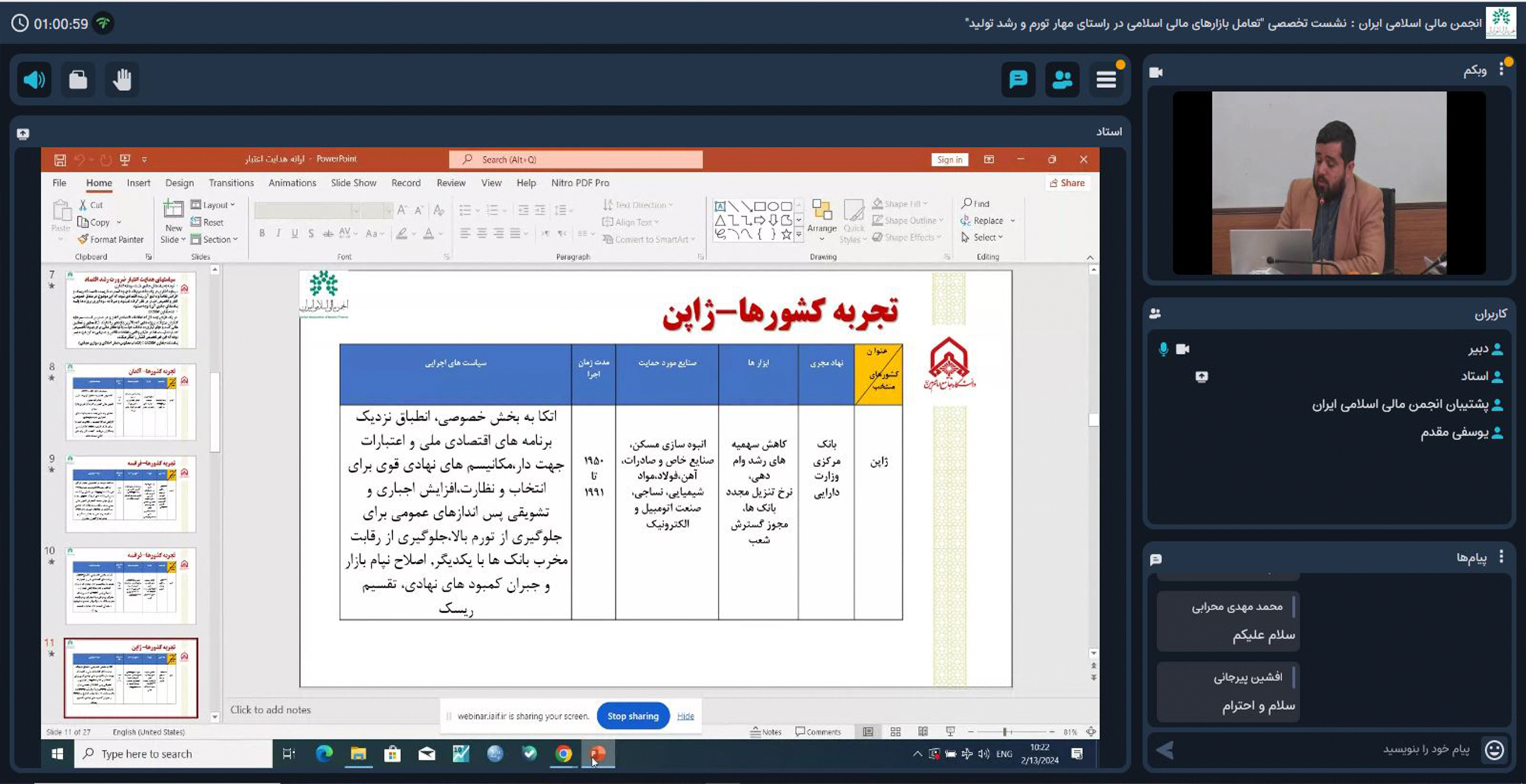

Regarding the importance of strategy of management to curb inflation and boom production, Ali Islamjo said the implementation of credit guidance is an essential strategy of money market management and production financing. The issue of credit direction is a serious debate and based on the conventional flow of the economy, the basis of credit direction is economic priorities. The market determines the direction of money and credit better than any activist. A different point of view is that credit should be directed by the government towards the country's development priorities, and it is not correct to abandon credit and guide it to the market.

As to the relationship between credit management policies and economic growth Islamjo said we are facing this phenomenon that monitoring and regulating the overall volume of credits and the quality of its allocation is a key variable in economic policy making that must be monitored and controlled. Banks' preference as creators of credit is to allocate it to non-productive and speculative activities to maximize the bank's short-term profits. Based on the experience of advanced countries, industrialization requires access to credit, and industrialization owes governance access to credit management. But banks, based on profit-seeking logic, tend to allocate their credits to activities that have short-term returns and low risk with sufficient assets and collateral. While I believe that it can lead to increasing in inflation and hurting production.

He added credit management policies have been used to grow priority sectors, finance innovations, access small businesses or farms, or reduce consumer loans and mortgage loans. Evaluating the performance of credit management policies in the form of financial indicators is actually removing the macroeconomic price and ignoring the goals and logic of those policies.

Mortezania emphasized that the behavior of activists in the economy is an important issue that should be paid attention to, mentioning that in the discussion of behavioral finance, behavior is a delayed issue compared to thoughts and beliefs; that is, opinions and beliefs are in the hard core and attitudes are formed in it that lead to behavior.

As to defining the Islamic economy, he said the economy in which Muslims interact and carry out transactions is the Islamic economy. If economic activists work with Islamic beliefs, Islamic economy will be formed. Therefore, behavior is a delayed issue and the effect of beliefs is not a quick effect and shows its influence in a long-term period.

He said conventional behavioral finance focuses on cognitive and emotional aspects, applying studies, cognitive psychology in the financial field of human mind structure and its impact on financial decisions.

Mortezania mentioned that Islamic behavioral finance studies have mainly focused on trying to explain the behavior of investors and customers towards their decision to interact with Islamic finance, Islamic stock market and other Islamic products and technologies. Previous studies have tried to understand the impact of psychology and religion on the intentions of Muslim investors.

Mohammad Selgi said due to the operational, allocation and informational efficiency of the capital market, even the government, which usually breaks its promise , has kept its promise in terms of issuance of treasury documents. According to the available statistics in developed countries, 75% of the financing of companies is done through the capital market. Most of the researches in developing and developed countries indicate the impact of the development of financial markets on economic growth.

Hw went on to say that the full implementation of the corporate governance system in bond issuing companies, accurate and effective supervision of auditors and their executive processes, determining specialized conditions for membership in the board of directors of bond issuing companies, closer monitoring of the internal audit units of bond issuing companies, encouraging the creation of credit rating institutions, etc. are among the things that will be effective for the development of the debt bond market.

At the end of this meeting, Gholamhasan Taghi Netaj said the focus is on legal entities and there is no wall shorter than the wall of banks! One of the strategic mistakes is the continuation of the wrong imposition of public sector costs on the shoulders of banks and so-called private banks, which results in the creation of unhealthy liquidity and indirect borrowing from the central bank.