The Iranian Association of Islamic Finance (IAIF) held an online pre-session on The 9th Islamic Finance Conference.

The Iranian Association of Islamic Finance (IAIF) held a pre-session on The 9th Islamic Finance Conference on February 4, at 2:00 PM Iran Standard Time.

Prof. Dr. Syed Musa Alhabshi, Former Dean, IIUM Institute of Islamic Banking and Finance International Islamic University, Malaysia

The Role of Islamic Finance Industry in Financing Enterprises

Finance as a discipline and body of knowledge can be defined from technical, operational and strategic perspectives. Financial management significantly relate to the decision-making process whilst corporate finance focus on the corporate investor wealth management function.

Development finance deals with both private and government sector needs. Financial system articulates the components and mechanisms of the system Social Finance focus on the social needs of the society with specific reference to social and environmental responsibilities.

Finance decisions are classified as financing, investment and dividend decisions. Investors expect wealth maximization in terms of shareholder value, while customers expect service quality in terms of customer value. Sustainable value would be a composite of shareholder and customer value.

Nature and Purpose of Islamic Finance

A prescribed behavior engaged in financial activity that is in accordance to the religion of Islam demonstrated by Shari’ah guided activities based on prescribed principles and rules and manifested in form of products, instruments and services within a regulatory and governing framework the promote the goals (Maqasid) of Shari’ah’.

Optimal Corporate & Shariah Governance Considerations

Policy analysis and formulation for proper and effective governance structure, process and culture are significantly influence by the underlying principles and theories in balancing policy options to regulate for public interest (trust) or govern for stakeholder interest (trust). Principle of Optimality is examined in each of the following situations:

Investor –Manager Behavior

• Opportunistic vis-a-vis Efficiency Behavior

• Agency (conflict) vis a vis Stewardship Relationship (congruence)

Organizational Structure

• Rule vis a vis Principle Based Approach

• Regulation (compliance) vis a vis Governance (assurance) Mechanism

External or Internal Process

• Internalization vis a vis Transaction costs

• Investment/Trading vis a vis lending

Statutory or Social Disclosure

• Economic Decision Usefulness vis a vis Reporting Accountability

• Public confidence vis a vis Market discipline

• Investor vis a vis Stakeholder Perspectives •

Investment Account Holders vis a vis Shareholders Interest

• Proprietary (confidentiality) vis a vis Transparency (Disclosure)

Performance

• Performance vis a vis Value Proposition

• Profitability vis a vis Liquidity objectives

Financier – Entrepreneur Financing Duties/Engagement

Financier duties

• Financial product and services provide customer/social value

• Financial product and service are approved by Shariah on permissibility, validity and legitimacy

• Presenting an accurate, representative and reliable product information and customer disclosures

• Providing sound financial advice and support to the customer needs.

• Conducting timely, proper and effective monitoring and assessment of financing status and conditions.

• Protecting and securing customer data proprietary.

Entrepreneur duties

• Establishing a legal and legitimate business/social activity.

• Fitting and proper as CEO/Director to represent the business/social entity

• Presenting adequate/sufficient disclosures to facilitate financing approval and disbursement

• Pursuing collaborative network/linkages that present both opportunities for growth and sustainability.

• Core business focus on product/services innovation and continuous improvement.

• Focusing on building trust and brand value for higher funding engagement.

Eco system for Sustainable Islamic Financing for Enterprises

• Islamic finance communities comprise of both Muslims and non-Muslims who embrace the Shariah principles for the proper and appropriate conduct of Islamic financial activities that advance the permissible profitable and socially beneficial activities that promote the common good for mankind.

• The prospects and growth to advance Islamic financing is correlated to the human development of Islamic finance communities in terms of Islamic financial literacy, knowledge, skills and expertise that are adaptive to the socio-economic needs and the relevant opportunities.

• An integrated Islamic enterprise financing that assume the socio-ethical religious roles would provide a balanced approach to financing needs of enterprises given their risk appetites and strategies.

Prof. Dr. Habib Ahmed, Sharjah Chair in Islamic Law & Finance, Durham University Business School

Islamic Finance: Current Issues, Global Practices and Future Directions

Developing countries will face a gap of $2.5 tn. annually to achieve sustainable development goals (SDGs) —this figure has increased in the post COVID era to $4 tn. Hence public, private and nonprofit sector contributions are needed, moreover, the financial sector has an important role to promote SDGs.

Financial Sector and SDGs

Quality of finance has to change:

•Must consider sustainability issues (impact on people and planet)

•Use more asset/equity-based modes of financing (financial stability)

UN Objectives to Finance SDGs:

Seizing the potential of financial innovations, new technologies and digitalization to provide equitable access to finance.

Islamic Finance and Sustainability: Synergies and Gaps

• Islamic values and principles are aligned with Sustainable Development

• The practice of Islamic finance not supporting sustainability

• This is partly due to ‘reverse engineering’ innovation—mimicking of conventional financial products

• Radical innovations needed to fill the gap between the ideals and practice

Islamic Finance Innovation: Meaning

• Meaning: Shariah compliance fulfils a religious obligation

• Has both legal and ethical considerations

• Products can have different meanings depending on how Shariah compliant is defined

• Shariah compliant: fulfilling the legal form (halal)—marginal innovation

• Shariah based: Fulfilling the legal form, ethics and maqasid al Shariah (halal and tayyib)—radical innovation

Sustainability Implications of Meaning on Islamic Finance Product Innovation

• Current practice—marginal innovation (formal legal compliance)

• Radical innovation: Ethical values must be embedded in product development along with legal compliance

• Maqasid related to transactions-justice, transparency, etc.

• Consider the implications of impact on maqasid (environmental sustainability)

• Moving from marginal meaning to radical meaning would require using ‘Innovative engineering’

• Start with needs and develop appropriate product to fulfil the need

• Product types

• Shariah based sustainable/green and halal/ tayyib products

• More asset- and equity-based financing products

Sustainability Implications of Meaning on Organizational Innovation

• Islamic banks are structured as share-holders centered companies using organizational formats of interestbearing debt-based institutions (marginal Innovation)

• Following Islamic principles and values calls for new forms of non-bank financial institutions

• Stakeholders model, cooperatives,

• Non-banks financial institutions (for asset/equity based financing)

• Unique Islamic financial institutions: Mudarabah companies, Tabung Haji, etc.

• Social enterprises can be established as alternatives to for-profit banks

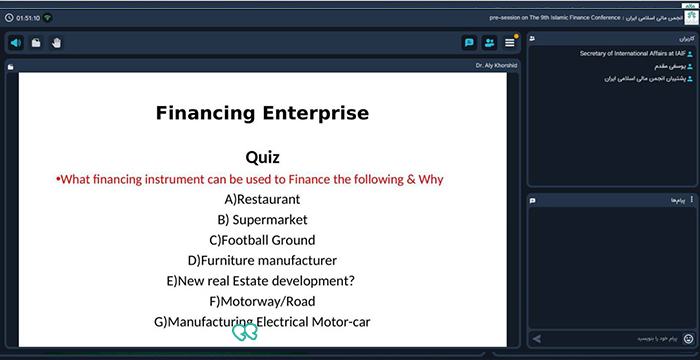

Prof. Dr. Aly Khorshid, Dean of Business & Economics School, Lonon Uni

Islamic financial instruments and financing of enterprises

There are 1.7 billion Muslims in the world (23% of the total world population) with an annual growth of 15% (in 2020 Muslim population is expected 25% of the world population), making it 2nd largest religion after Christianity and only 20% of those live in Arab Countries. The market of Sharia-compliant assets is approximately $1.2 Trillion.

Prohibitions in Islam are as follows:

• Prohibition of Unfairness & Unjust

• Prohibition of Riba (usury)

• Prohibition of Gharar (Deception & Speculation)

• Prohibition of Gambling

• Prohibition of Monopolies

• Prohibition of Short Sales

• Prohibition in money trading(Money is a medium, not a commodity)

• Prohibition of Dealing in Unlawful or Unethical Goods or Services

What is Riba?

Riba is prohibited in Judaism, Christianity before Islam and even in man-made religions such as Hinduism and Buddhism. It is unearned increase in an exchange contract without offering anything in return.

Examples of Riba are interest on bank loans and credit cards, gains from trading bonds or other debts and interest earned on savings and other deposit accounts.

What Is Gharar?

Gharar is an ambiguity in transactions and selling anything without owning it first.

Islamic finance is based on the principle of both profits and risks sharing in respect of investment being shared between the financier and the customer. Islamic investors share the risk and the profit according to their investment and pre-agreed role, while conventional financing focuses on employing funds on a cost-for-time basis and charging interest (Riba).

Islamic financial instruments

• Ijarah (Operating lease)

• Ijarah wa Iqtina(Finance lease)

• Mudarabah(participation or Trust finance)

• Murabah(Cost-plus financing)

• Musharakh( Equity financing)

• Istisna’a(Construction financing)

• Qard Hassan (Interest-free loan)

• Sukuk( Islamic Bonds issue)

Musharakh is a partnership arrangement and involves a mutual contract to participate in a commercial enterprise.

Mudarabah is a special kind of partnership in which one partner invests money with another entrepreneur in a commercial enterprise.

In Murabah a financer will purchase the commodity for the buyer, The financer specifically stipulates, that the cost of acquiring the commodity as well as the amount or percentage of profit or mark-up price for the commodity is agreed between them in advance of the purchase.

Istisnaa is used to provide financing, especially in the housing finance sector.

The financier constructs the house and then enters into a parallel Istisna'a contract with a third party or he may hire the service of a contractor (other than the client).

Istisna'a allows the parties to fix cost at the time of the contract and the payment may also be on an instalment basis.

To download the presenation files, click the following links: