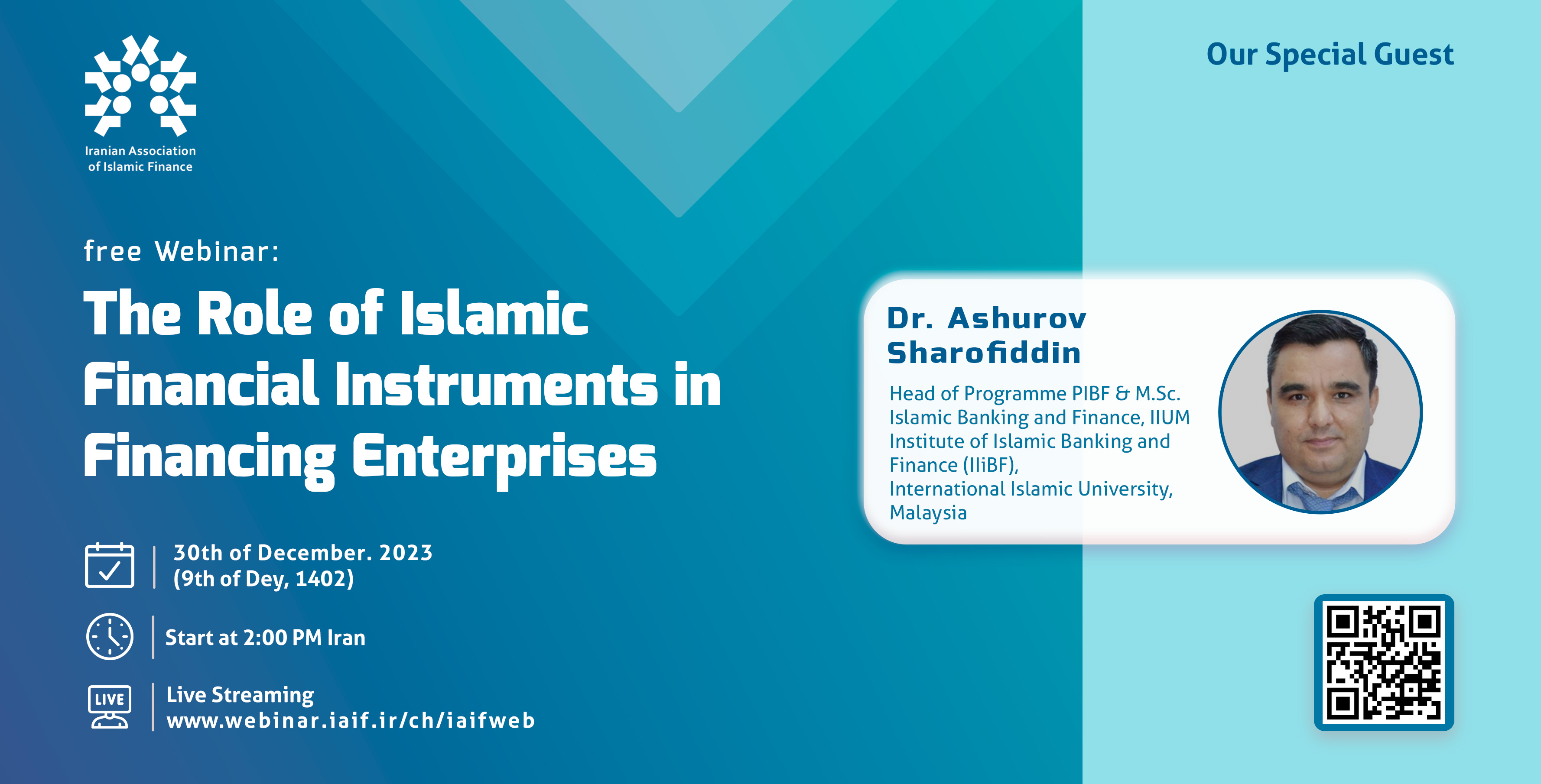

The Iranian Association of Islamic Finance held an international webinar on “The Role of Islamic Financial Instruments in Financing Enterprises.”

The Iranian Association of Islamic Finance held an international webinar on “The Role of Islamic Financial Instruments in Financing Enterprises” on the 30th of December at 2:00 PM Iran Standard Time.

Speaker:

Dr. Ashurov Sharofiddin, Head of Programme PIBF & M.Sc. Islamic Banking and Finance ( ARABIC)

IIUM Institute of Islamic Banking and Finance (IIiBF)

International Islamic University Malaysia

Entrepreneurship (SMEs) plays a vital role in the economy, driving innovation, creating jobs, and contributing to economic growth.

• Entrepreneurs can be found in all industries and can range from small business owners to founders of large technology companies.

• SMEs’ support towards economic growth and development has influenced the country’s GDP.

• Despite that, the sector still faces several main constraints including a lack of access to credit from formal financial institutions.

• Islamic financial institutions pursue a specific objective, that is, to endorse a holistic approach in supporting business and advocate entrepreneurship, productive activities, and risk sharing.

• Additionally, Islamic financial institutions also pursue Islamic religious principles that mandate social responsibility and assistance for those in need.

Contribution of IFIs:

Provision of funds to overcome financial constraints

Imparting skills and business knowledge

Facilitating entry and expansion in new markets

Promoting long-term economic development

ISLAMIC FINANCE SEEN DEVELOPING AROUND THE WORLD

Over 1,850 Islamic financial institutions operate in 90 countries.

. AccordingtoIFDI2023, the largest Islamic finance markets are based in the GCC, Southeast Asia, and South Asia. Sukuk outstanding are held in 29 countries while Islamic funds are managedbyassetmanagersbasedin28countries.

. The industry is heavily concentrated in the top markets: the top five countries (Iran, Saudi Arabia, Malaysia, The UAE and Kuwait) account for82% of total global assets. The highest growth during 2022 is in the regions that only recently started adopting Islamic finance, such as Sub-Saharan Africa and Central Asia.

Islamic Social Finance Financing Instruments

Sources of Fund: Zakat, Sadaqah, Infaq, Waqf and so on

Exchange contracts: Murabahah, Mu’awadat, Ijarah

Partnership Contracts: Mudarabah, Musharakah, Muzara’ah

Through these instruments, Islamic financial institutions pursue specific goals, namely, to support a holistic approach to supporting business and entrepreneurship; productive activities; and risk management.

In addition, Islamic financial institutions also pursue Islamic religious principles that mandate social responsibility and assistance for those in need.

Evaluation of Infaq, Sadaqah & Zakat as an Islamic Financial Instrument to Finance Entrepreneurs

. Infaq should be carried out with something good, beneficial and worthy, which may include fruits or vegetables that are grown by someone on his own land which he later donates.

. In describing the nature of infaq, Al-Quran stated that: “O believers! Donate from the best of what you have earned and of what we have produced for you from the Earth. Do not pick out worthless things for donation, which you would only accept with closed eyes. And know that Allah is Self-sufficient, Praiseworthy”.

The main purpose of doing infaq is to ensure the existence of economic harmony in the society and it is vital for the social, economic, and development of the community.

Crowdfunding Model to Invest Entrepreneurship

1- The entrepreneurs proposes their project.

2- The platform reviews the project, provides agreement and launches the campaign.

3- Funders fund the project

4- The platform channels the fund under the concept of Qard al- Hasan

5- After the period of time, the entrepreneur pays back the money.

In summary

. Islamic financial instruments stand as a testament to the adaptability and resourcefulness of financial systems to cater to diverse ethical and religious needs.

. Their role in financing entrepreneurs is not only pivotal but also transformative, offering a bridge between modern economic demands and time-honored Islamic principles.

. This not only fosters a conducive environment for business innovation and growth but also contributes significantly to the inclusive economic development of communities.

. As the global financial landscape evolves, the integration of Islamic financial instruments into mainstream finance could further diversify and enrich the support ecosystem for entrepreneurs worldwide

Conclusion

. Infaq, Sadaqah, and Zakat represent fundamental Islamic financial instruments that have profound implications for financing entrepreneurs. These instruments, deeply rooted in Islamic philanthropy, serve not only as a means of spiritual purification but also as effective tools for social empowerment and economic sustainability.

. By channeling funds from those with surplus to those in need, they foster an environment where entrepreneurial ventures can thrive, particularly for those who may be financially excluded from conventional banking systems.

. The strategic deployment of these funds as interest-free loans or grants can significantly alleviate financial barriers for budding entrepreneurs, paving the way for innovation, job creation, and community development.

. The integration of Infaq, Sadaqah, and Zakat into contemporary Islamic financial systems underscores a model where financial mechanisms are leveraged to achieve broader socio-economic goals, reflecting the ethical and egalitarian ethos of Islamic finance.

. This not only contributes to the financial inclusion of entrepreneurs but also enriches the economic tapestry by infusing it with social responsibility and ethical considerations.