IAIF held the International webinar on ‘Development of Islamic Finance Markets in A Multipolar World’.

The Iranian Association of Islamic Finance held an international webinar on Development of Islamic Finance Markets in a Multipolar World on 12. April, 2022.

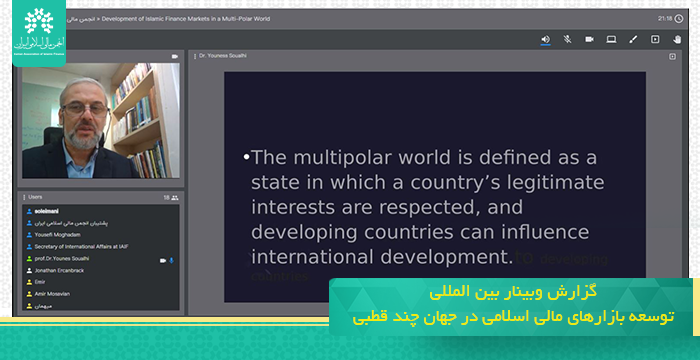

Prof. Dr. Younes Soualhi , Senior researcher at INCEIF UNIVERITY from Malaysia

The speaker at first mentioned the multipolar world is defined as a state in which a country’s legitimate interests are respected, and developing countries can influence international development and geopolitical tensions—coupled with the COVID-19 pandemic—have contributed to deglobalization, setting the scene for a broader world order: multipolarity.

Soualhi said a multipolar world is already driving changes in:

Correlations for industrial production cycles

Global commodity prices

Bond and equity market returns

He stated multipolarity tends to favor companies and sectors whose supply chains are not globally complex and whose products and services don't pose a threat to economic or national security.

Multipolarity can be seen in:

Intra trade (emerging and developing countries)

Rise of regional development and investment banks (Asian infrastructure and investment bank)

Financial market trends are becoming less US-centric and more multipolar in nature.

Moreover, mlutipolarity Increases rivalry between the U.S. and China is one of the most visible drivers.

Regarding the effects of Multipolarity, the INCIEF’s snior researcher said it:

May lead to leadership vacuum that fuels geopolitical instability in the years to come.

May exacerbate global governance challenges.

May have undesirable consequences for the long-term development of systemically important sectors such as energy, financial services and healthcare. Companies, industries and sectors that have globally integrated supply chains, especially those with technology and health security liabilities, could be increasingly vulnerable to multipolar trade and national or economic security policy trends.

Islamic Finance Positioning itself in a Multipolar World to:

Deglobalizie of OIC economies

Internationalize of viable Islamic finance models of financing and funds raising

Focus on sustainability and value based intermediation within maqasid al-Shariah

Suggestions:

Backing local currencies of Muslim countries with Gold for regional and international trades settlement

Establishing more regional and international banks among OIC countries

At the end he said Islamic Finance has the potential to present a viable system that fits the new multipolar landscape. Strategic alliances of Muslim countries with their counterparts sharing common values, are needed to internationalize Islamic financial products in the new deglobalized world. Furthermore, Islamic finance can target clients with less complex global supply chains.

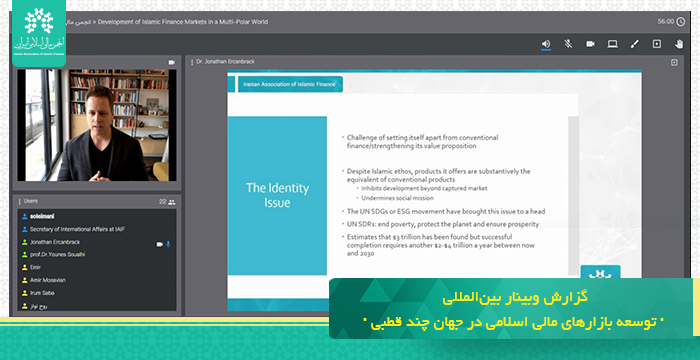

Dr. Jonathan Ercanbrack, Chair Centre of Islamic and Middle Eastern Law, Senior Lecturer in Transnational Financial Law, SOAS University of London

The speaker in the beginning of his lecture dealt with the challenge of setting Islamic finance apart from conventional finance can strengthen its value proposition.

Despite Islamic ethos, products it offers are substantively the equivalent of conventional products.

Slow growth of Islamic finance can inhibits development beyond its captured market and undermines social mission.

The UN SDGs or ESG movement have brought this issue to a head.

UN SDRs are to end poverty, protect the planet and ensure prosperity.

It is estimated that $3 trillion has been found but successful completion requires another $2-$4 trillion a year between now and 2030.

Islamic Finance is an important contributor because:

Significant development issues profoundly affect Muslims and Muslim majority countries.

40 per cent of the world’s poor who live on $1.25 or less, live in Organization of Islamic Conference (OIC) states.

Humanitarian disaster related to natural catastrophes as well as conflict affects OIC states disproportionately

30 of 50 conflicts in 2015 recorded worldwide having occurred in OIC countries.

More than 68.5 million people worldwide have been forcibly displaced with just 5 countries, all of them Muslim majority

These displaced persons account for 68 per cent of refugees under the mandate of the UNCHR.

Seventy-one per cent of people worldwide who require humanitarian assistance reside in OIC countries.

World Bank, IMF, United Nations agree Islamic finance plays a large role.

Somewhere else the speaker raised this question; Islamic Finance or Islamic Social Finance? He stated:

There is a wide agreement that Islamic finance can play an important role in facilitating these funding needs.

There is a disagreement as to how or whether the industry already has integrated ESGs into its methodologies for producing financial services and products.

Zakah, awqaf and other forms of charity have existed for a very long time, although impact they are not accurately measured.

There is a debate, in large part, centers on how the industry and its proponents define Islamic finance.

Differing Methodologies – Islamic Finance v Social Finance:

Sharia boards concerned with the legitimacy of financial instruments and the acceptability of contracts under Islamic law.

Fatwas focus on sharia audit and compliance concerning the legal structure of financial instruments, rather than the impact and purpose of the funding.

Most applicants for funding aware of the types of projects which are acceptable and what is unacceptable.

In practice, the purposes for which funding is used is largely a matter for the applicant, not the bank or the sharia board.

Social Finance Funding Methodology:

More focussed on the purposes for which funding is utilised

Finance to be used for activities classified as “social”, implying a wider impact that benefits society is sought and not merely one which benefits the owners of companies whose projects are funded (profit maximisation)

Social finance banks strive for positive externalities and favourable multiplier effects in their extension of credit

Not uniquely preoccupied with the common good, but balance sheets embody a different conception of the common good compared to Islamic as well as mainstream commercial banks

Assess performance by means of not only financial ratios, but also social indicators

Commensurate with SDGs

Regarding the Traditionalist View, the chair center of Islamic and Middle Eastern law at SOAS University said:

Most academics/practitioners view Islam and its modern developments such as Islamic finance as intrinsically social

Not merely capable of meeting SDGs but, by definition, encompassing those goals and possibly extending beyond these to deal with more multidimensional ones which relate to God and the hereafter

Should be no separation in meaning between Islamic Finance and Islamic social finance.

Islamic principles originate in the sharia and therefore an industry which seeks to orient itself to such principles is necessarily compatible with social goals

The Pragmatists:

Islamic finance must actively seek to define itself as a form of social finance

More inclusive and widely adopted form of finance

Can broaden its global appeal in defining itself as social

Concern that the traditionalist view is idealistic and ignores the modern industry’s legalistic adherence to sharia

Legalistic approach minimizes debt fuelled growth has not sought to align itself with the SDGs

In practice, very few Islamic financial institutions (IFIs) currently use SDGs as part of their business model although some momentum in relation to the launch of the UN Principles for Responsible Banking whereby a small number of Islamic banks are engaging with this initiative

Islamic finance: a financing proposition shaped not only by legalism but also by values relevant to sustainability

The Legal Solution:

Maqasid al-sharia widely seen as the tools with which this change can be facilitated.

Historically, the classifications: necessity (darurah), needs (hajiyat) and luxuries (tahsiniyat).

Fundamental areas of ‘necessity’ deemed essential to preserve and protect: religion/faith, life/soul, offspring/progeny, intellect/mind, property/wealth and honour.

Can be safeguarded and sustained through Islamic social finance.

Contemporary theorists: maqasid do not cover specific issues for particular groups or topics, e.g. families, societies and mankind or on areas relating to justice and freedom.

Traditionally derived mainly from the Islamic legal heritage (fiqh) and not from the original sources.

Expanded maqasid to encompass three new positions:

(1) The general maqasid, which includes the three levels of necessity and the new proposed maqasid including justice and facilitation.

(2) The specific maqasid that relates to a particular topic or subject matter within Islamic law.

(3) The partial maqasid which refers to the intents behind a specific script, source or judgment.

At the end Dr. Jonathan Ercanbrack, regarding Maqasid Based Market Developments said Malaysian central bank (2018): the Value-Based Intermediation (VBI) Financing and Investment Impact Assessment Framework:

Aims to deliver sharia outcomes through financial practices that generate positive and sustainable impact to the economy, community, and environment

Alignment between the Malaysian value-based intermediation initiative and SDGs is unmistakable

(VBI) framework did not set out any legal principles, but it involved a change in the thinking, practice, and expectations of the industry players

(VBI) is defined as “an intermediation function that aims to deliver the intended outcomes of sharia through practices, conduct and offerings that generate positive and sustainable impact to the economy, community and environment, consistent with the shareholders’ sustainable return and long- term interests”

(VBI) encourages Islamic finance to incorporate elements that reflect SDG values.

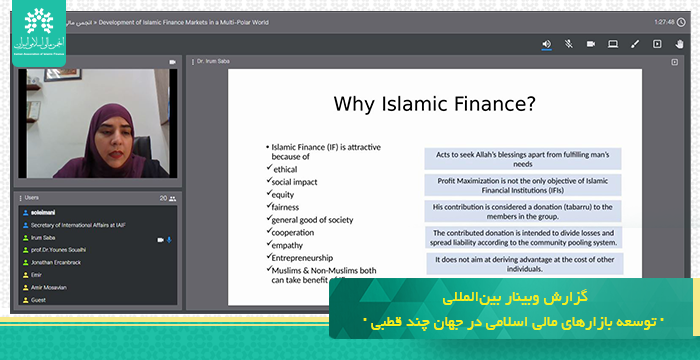

Asso. Pro. Dr. Irum Saba, Program Director- MS Islamic Banking and Finance- IBA Karachi, Shariah Board Member-Salaam Takaful

At first the speaker raised this question: Why Islamic Finance? Then she replied that Islamic Finance (IF) is attractive because of:

Ethical

Social impact

Equity

Fairness

General good of society

Cooperation

Empathy

Entrepreneurship

Muslims & Non-Muslims both can take benefit of IF.

Moreover, Islamic finance acts to seek Allah’s blessings apart from fulfilling man’s needs.

Profit Maximization is not the only objective of Islamic Financial Institutions (IFIs).

His contribution is considered a donation (tabarru) to the members in the group.

The contributed donation is intended to divide losses and spread liability according to the community pooling system.

It does not aim at deriving advantage at the cost of other individuals.

She mentioned that Islamic finance is here to stay:

Islamic Economics/ Islamic Banking/ Islamic Insurance/ Islamic REITS/ Islamic Mutual Funds/ Islamic Leasing Companies/ Shariah Compliant Stocks/ Islamic Social Finance (Zakat, Charity, Endowment (Waqf), Crowdfunding)/ Islamic FinTech/ Islamic RegTech/ Islamic SupTech.

In terms of Islamic finance Globally, Saba said:

There are 46 countries with Islamic Finance Regulations.

There are 1526 Islamic Financial Institutions.

There are 972 Islamic Finance Education Providers.

There have been 2,566 Research papers.

There have been 463 Islamic Finance Events.

Then she talked about the next hub of Islamic finance, saying Malaysia/Iran/KSA/ Pakistan/ Oman/ UK/ Turkey and Sudan could be the pioneer nations in this area.

Why SDGs are important?

Contribution of all countries for the achievement of SDGs to make this world better and protected.

Annually USD 3-4 Trillion needed to achieve SDGs till 2030.

The speaker stressed that the Sustainable Development Goals (SDGs), are a universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity.

The UN estimates the gap in financing to achieve the Sustainable Development Goals (SDGs) at $2.5 trillion per year in developing countries alone

Islamic Finance emphasizes on inclusiveness and broad understanding of business society relations.

This allows Islamic finance principles to be highly aligned with the SDGs – UNDP.

Forging new partnerships in this area will be essential to provide the much-needed reinforcements to finance and implement 2030 Agenda.

Islamic finance can help to achieve SDGs by using Mudarabah, Musharaka, Salam, Istisna and specially through the Green sukuk both local and foreign currency sukuk based on different modes as per the need of the countries. Malaysia and Indonesia are key examples for Green Sukuk.

Islamic Finance have huge potential for SDGs achievement but need governments’ support and enabling environment.

At the end the speaker concluded that:

Islamic finance is our religious duty.

There is a need to create awareness of Islamic finance.

Islamic finance and Islamic social finance should be promoted.

Collaboration among international and local partners of industry and universities is the key to success.

Islamic finance promote SDGs and ethical finance with strong value propositions.

FinTech is underutilized in Islamic Financial Institutions.

Non-Muslim States and Muslim States should work together.

Multilateral Standards Setting bodies have important role to play in Islamic finance such as IDB, ADB, AAOIFI, IIFM, IILM, CIIF, IMF, World Bank, also regulatory authorities and Governments.