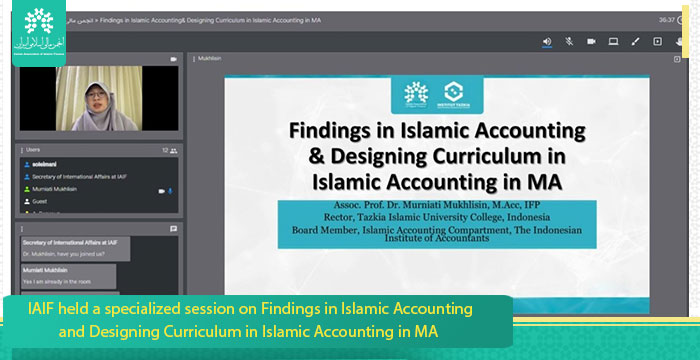

IAIF held a specialized session on Findings in Islamic Accounting and Designing Curriculum in Islamic Accounting in MA.

The Iranian Association of Islamic Finance held a specialized session on Findings in Islamic Accounting& Designing Curriculum in Islamic Accounting in MA on 5th of March, 2022.

The invited speaker was Dr. Murniati Mukhlisin, Rector at Tazkia Islamic University College from Indonesia and a board member at Islamic Accounting Compartment, the Indonesian Institute of Accountants.

At first she said Fra Luca Bartolomeo de Pacioli (sometimes Paccioli or Paciolo; c. 1447 – 19 June 1517) was an Italian mathematician, Franciscan friar, collaborator with Leonardo da Vinci, and an early contributor to the field now known as accounting. He is referred to as "The Father of Accounting and Bookkeeping" in Europe and he was the first person to publish a work on the double-entry system of book-keeping on the continent.

Regarding the harmonization of Islamic accounting in terms of sharia view, the speaker mentioned the result also shows perceptions of respondents on the Shariah harmonization efforts by AAOIFI that mainly emphasize on the fact that efforts should be made by AAOIFI.

For instance, AAOIFI should be able to organize more rigorous socialization to Islamic scholars and management board of Islamic bank on Shariah issues on every newly issued accounting standard and to work more closely with country authority to ensure the harmonization to take place. This result also supports earlier views that suggest that more constructive efforts should be exercised by AAOIFI to ensure adoption of its standards.

As to the non-Islamic accounting scandal case, she touched upon Toshiba Corp. that a subsidiary booked fictitious sales of ¥43.5 billion in 26 transactions recorded only on paper. The scandal may again throw Toshiba into a crisis similar to its massive accounting fraud in 2015. The subsidiary in question is Toshiba IT-Services Corp. based in Kawasaki.

Moreover, the Enron scandal, exposed in October 2001, eventually led to the bankruptcy of one of the largest American energy companies and the dissolution of accounting giant Arthur Andersen. Many executives at Enron were indicted for a variety of charges and sentenced to prison. The company and its advisors lost the majority of their customers and closed. Employees and shareholders received limited returns in lawsuits, despite losing billions in pensions and stock prices.

Could a similar scenario take place in the heavenly haven of Sharia-compliant finance?

The Islamic finance industry prides itself of its healthy and ethical governance. Over the years and after the turmoil of the 2008 financial crisis, it has become a welcome landmark and an alternative to the ill conventional banking system.

Nevertheless, the crystal-clear water of Islamic finance may be troubled by internal and external winds. In fact, the stormy issue involves the entire Islamic economy, not just the Islamic finance or banking microcosm.

Dr. Mukhlisin referred to Abdullah bin Muhammad bin Kayah Al Mazindarani, a Muslim scholar who wrote works in the field of accounting. “Risalah Falakiyah Kitab as Siyaqat” which was written on 765 H/1363 M in manuscript form, but not yet printed and not published. Al Mazindarani has written it approximately 131 years before Pacioli's book appeared.

Al Mazindarani explains in his manuscript about the implementation of bookkeeping which was popular at that time complete with all rules that must be followed.

He says if there is still an empty space in the book, for whatever reason, it must be delimited, so that the empty space cannot be used. This line is known as Tarqin. The accounting balance must be issued regularly. The balance is known as Hashil. The transactions must be well recorded according to the date of occurrence. Recording transactions must use the correct expression, and be careful in using words.

It is not allowed to correct transactions that have been recorded by scribbling or deleting them. If an accountant (treasurer) records the excess amount of a transaction, then he must pay the difference from his personal pocket to the office. Similarly, an accountant forgets to record an expense transaction, so he must pay the amount of the shortage in cash, until he can trace the occurrence of the transaction. In an Islamic country, once an accountant forgot to record an expense transaction of 1300 dinars, so he was forced to pay that amount. At the end of the financial year, the deficiency can be identified then adjusted, namely when comparing the comparative book balance with the balances of other books, and the comparative balances in the office.

At the end of the financial year, an accountant must submit a detailed report on the (financial) amount that is under his or her responsibility, and the manner in which the (financial) amount is regulated. The annual report sent by the accountant must be checked and compared it with the previous year's report from one side, and from the other side with the amount recorded in the office.

Financial transactions must be grouped according to their character in similar groups, such as classifying and recording taxes that have one character and are similar in one group.

Income must be recorded on the right side of the page by noting the sources of these incomes. Expenses must be recorded on the left side of the page with sufficient notes. When closing the balance, there should be a special sign on it. After recording all financial transactions, they must transfer similar transactions into a special book provided for transactions of the same kind. Similar transactions should be done by another person who is independent, not related to the person who keeps records in diaries and other books.

After recording and transferring financial transactions in the books, it is necessary to prepare periodic, monthly or annual reports as needed. The report must be detailed, explain the income and its sources and its allocation.

According to Al Mazindarani, system accountancy which popular at the time around year 765 H/1363H that among others:

Agriculture Accounting

Warehousing Accounting

Money making Accounting

Maintenance Accounting

Animal Care Accounting

Professor of Tazkia University pointed to the Indonesian Institute of Accountants (IAI), going on to say that it was founded in 23 December 1957 and it is recognized as a Professional Accountancy Organization and home to Professional Accountants in Indonesia. The institute has 30,000 members approximately, almost 20,000 of them are Chartered Accountant (CA) holders. The institute has branches in all 34 provinces of Indonesia.

Shariah Accounting Standards Board of IAI develops standards based on the need of the industry, fatwa of National Shariah Board, Indonesian Council of Ulama and accounting best practice.

At the end, regarding Islamic Accounting curriculum in masters which was designed by INSTITUTE TAZKIA, Mukhlisin said this course discusses Islamic finance and accounting issues and practices in various regions and countries, such as GCC, European, Southeast Asian, South Asia, Sub-Saharan African, other MENA, other Asia and America. It starts with discussion on the development of Islamic finance and Islamic Financial Institutions (IFIs) in each country and how it is developed over time. Islamic accounting as philosophy is discussed using academic literatures on how it is perceived in countries under study. Likewise, Islamic accounting as financial reporting and governance standards for Islamic finance are analyzed. Political of accounting is examined to portray each country’s inclination towards its choice of standards. Standardization and harmonization on accounting standards for Islamic financial institutions are presented to draw recommendation after the whole lecture.

As to the chapter of Islamic ethics for accountants according to the syllabus of INSTITUTE TAZKIA in Islamic Accounting, she mentioned accountants have a responsibility to the society to clearly communicated information for decision-making. There is a growing concern that accountants, on many occasions, fail to provide the required information demanded by the society. It is also a growing concern over the apparently low moral standards of some accountants. The famous case of Enron in 1990s reiterated the lack of ethics among accountants. Many accounting scholars suggested that the education system should bear some of the blame. There is also crucial to re-examine the type of educational system that produces accounting.

Professionals who, consciously or otherwise, appear to act unethically realizing the lack of ethical components in accounting, this chapter suggests that the direction of accounting profession should be on religious ethical development and values in developing accounting ethics. The chapter suggests that the Islamic worldview and ethics can provide some insights into the process of developing an ethical accountant. This chapter reviews the Code of Ethics for accountants and auditors of Islamic Financial Institutions as developed by AAOIFI. This chapter also proposes the Islamic legal principle of Maslahah as a framework and an ethical filtering mechanism to be considered as a means to resolve ethical conflicts normally faced by accountants.