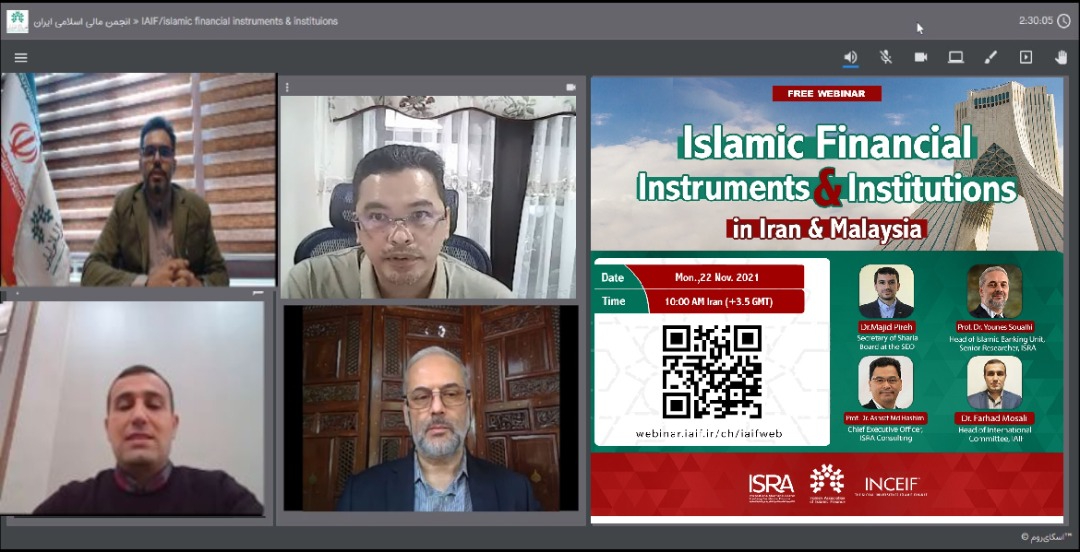

A webinar was held on financial instruments and institutions in Iran and Malysia in collaboration with IAIF, ISRA and INCEIF.

The Iranian Association of Islamic Finance held the webinar on Financial Instruments and Institutions in Iran and Malaysia in cooperation with ISRA and INCIEF on Monday, 22 Nov. 2021.

Presentation of Pro. Dr. Ashraf Hashim, Chief Executive Officer, ISRA Consulting

He said Alhajah paper was issued by the Central Bank of Malaysia last year to outline the situation and circumstance for financial institutions and examine some relaxation which can be given to them in terms of sharia principles. This relaxation is a temporary measure to overcome the Hajah issue.

The second point that he mentioned was regarding the benchmark of profit, going on to say that in the past it was based on inter-bank offering rate and it won’t be any more in the future so we have developed the Islamic over-night rate. Altough its mechanism is still based on inter-bank rate, the rate is calculated based on inter-Islamic banks rate.

The last point that Dr. Hashim stated was the establishment of Sustainable Unit which is closely working with Sharia Council of the Central Bank of Malaysia to develop and provide criteria and framework about how Islamic banks need to be helped.

Presentation of Dr. Farhad Morsali, Head of the International Committee at the IAIF

At first, the lecturere poited out Principle 44 of the Iranian Constitution referreing to privatization and it can

Increase the pace of national economic growth

Expand ownership to the general public in order to provide for social justice

Enhance efficiency of economic entities and utilize monetary, human and technological resources

Increase the share of the private and cooperative sectors in the national economy

And so on.

Then he pointed out the regulation history of the financial instruments and institutions in Iran which is classified into two parts:

Securities and Market Act in 2005: Demutualization which is separation of regulation and supervision from execution

Law for development of new financial instruments and institutions in 2009: Development of financial institutions

Morsali said the market structure consists of a policy maker, a supervisory body, exchanges, corroborative bodies and registrants.

He went on to say that associations in Iranian market structure include Securities and Exchange Brokerage Association, Iranian Institutional Investors Association, regarding the financial Institutions in Iran, stating there are 295 Funds, 108 brokerage firms, 10 investment banks, 20 financial advisers, 54 portfolio managers, 5 data processing companies, 125 investment institutions, 104 holding companies and 3 credit rating agencies.

Somewhere else he touched upon Waqf Fund in which both principle and proceeds are endowed and the asset includes the stocks of eligible companies; eligible companies’ fixed assets shall be 60 percent of their total assets.

Regarding the initiatives, Dr. Morsali mentioned the action of easing license issuance for brokerage firms and easing license issuance for Asset Management and Advisory companies led to the development of financial institutions in Iran; moreover, some measures have been done to pave the way for international financial institutions.

In the last part of his presentation, Head of the International Committee at the IAIF said there are still some challenges in Iranian market structure due to sanctions such as the absence of international financial institutions, data vendors and so on.

Presentation of Pro. Dr. Younes Soualhi, Head of the Islamic Banking Unit, Senior Researcher at ISRA

He said Malyalsia is now one of the leading countries in the world in terms of Islamic finance, Halal food, muslim-friendly travel and pharm/cosmetics.

He stressed that the Islamic Finance in Malaysia includes 41% Islamic banking and 18.4% Takaful (Islamic insurance); furthermore, the market share of Malaysia in global sukuk and Islamic funds is 45.1% and 26.9% respectively which is outstanding.

Dr. Soualhi mentioned the Islamic Finance ecosystem in Malaysia consists of human capital, research grants, legal and regulatory framework, supporting institutions, financial markets, Islamic financial institutions and unit trusts.

The senior researcher at ISRA stated Islamic capital market instruments in Malaysia include i-stockes, i-indices, i-ETFs, i-REITs and ETBS which are known as sharia-compliant instruments.

Regarding the green sukuks he said Malaysia is leading in this area and most of the green sukuks are based on solar and renewable energies.

In terms of Takful market, he said the share of Malaysia in 2019 was 1856 million dollars, while Iran’s share was 10880 million dollars and went to the first place.

Presentation of Dr. Majid Pireh, Secretary of Sharia Committee at the SEO

He took a brief look at Islamic financial instruments in Iran financial system, going on to say that the first sukuk was issued in 1994 by Municipality of Tehran for financing the construction of Navvab Highway in Tehran, so Musharakah sukuk was an only available sukuk in Iranian financial system for many years.

Regarding the reforms in Sukuk issuance procedure, he said until before 2005 just listed companie, state owned companied and municipalities could issue Musharakah sukuk, but based on the Ratification of New Act in 2009, sukuks were issued in forms of Ijarah, Murabaha and Salam.

As to the establishment of Sharia Committee in the capital market, he said it was founded in 2006 and this committee publishes regulations about financial instruments, financial institutions and contracts.

Also Dr. Pireh mentioned the Sharia Council of the Central Bank was established in 2017 consisting of 5 sharia scholars, Governor, one economic expert, one legal expert, one state bank CEO and one Member of Parliament. He emphasized that it must be developed more in upcoming years.

Speaking of the market share of sukuk in Iran capital market, he said approximately 88 % of it is financed in the government and state owned companies, 11 % is financed in private sectors and the rest is financed in municipalities.

At the end, Dr. Pireh said there are two challenges in the capital market: fisrt, can we add derivative products to sukuks?

Second, is equity-based Ijarah sukuk leasable from the Sharia perspective?

To watch the video of the presenters, click the following links: