The IAIF held a specialized session online on the process of issuing Islamic securities in Iran capital market on 4 Feb. 2021.

Abou Torabi, CEO of the Central Asset Management Company of the Capital Market said in today's economic conditions, many economic enterprises are concerned about financing projects. Lack of sufficient financial resources has affected the investment of legal entities, services and production; moreover, it has hindered their development and progress. There are various ways to finance companies, one of which is financing through the issuance of Islamic securities.

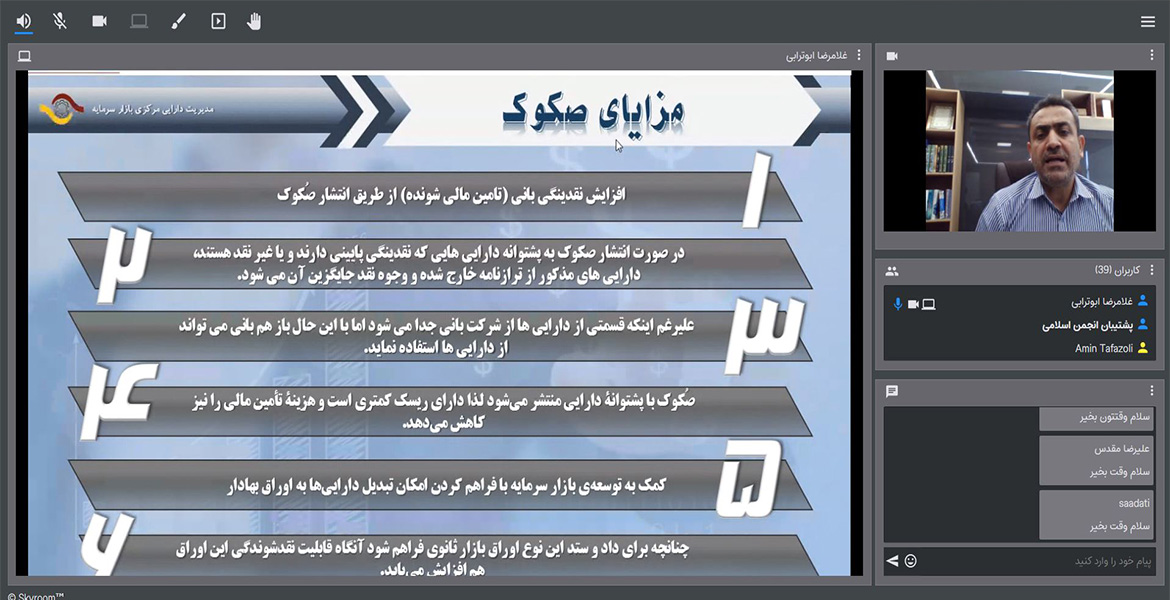

Benefits of Sukuk:

1. Increasing the liquidity of the sponsor

2- In case of issuance of sukuk on the basis of assets that have low liquidity or are non-cash, the mentioned assets is removed from the balance sheet and cash is replaced with it.

3. Despite the fact that part of the assets are separated from the sponsor company, the sponsor can still use the assets.

4. Sukuk is issued based on asset support, so it has less risk and reduces the cost of financing.

5. Contributing to the development of the capital market by providing the possibility of converting assets into securities

6- If the secondary market is provided for trading this kind of security, then the liquidity capability of these securities increases.

Types of sukuk:

Islamic financial instruments are divided into two categories: for-profit and non-profit instruments

Non-profit instruments include endowments and Gharzolhasane bonds, and we have not yet been able to issue these bonds in the capital market.

For-profit instruments are divided into two categories: instruments with expected returns such as Mosharekah and Mudaraba bonds

Instruments with certain returns such as: Ijarah bonds, Murabaha bonds, mortgage bonds.

Pillars of issuing sukuk:

1- A sponsor is the first and most basic pillar and is the applicant for financing. It is a legal entity that the intermediary institution issues securities to finance it in the form of Islamic contracts. A sponsor includes state-owned agencies, state-owned companies and municipalities.

2. An issuer is a financial institution that is formed in the legal form of a limited company by the Central Asset Management Company of the Capital Market.

3- A guarantor is a legal entity that guarantees the payment of interest and financial obligations of the sponsor.

A guarantor is not required if you have a BBB or higher credit rating or pledge securities.

Ijarah bonds:

In Ijarah bonds, the right to use the benefits of an asset or set of assets in exchange for rent is transferred from the owner to another person and has a maturity.

Types of Ijarah bonds:

1- Ijarah bonds to provide assets: These are bonds in which the issuer buys the asset from the seller on behalf of the investors and rents it to the sponsor.

2- Ijarah bonds to provide liquidity: In these bonds, the sponsor sells his property to another person and re-rents it.

Financing process:

Referring the sponsor to the supply consultant

Reviewing the sponsorship conditions for issuing Ijarah bonds

Making a contract with a supply consultant and designing a financing method through the issuance of Ijarah bonds

Issuing a license to issue Ijarah bonds by the Securities and Exchange Organization

.

.

.