The IAIF held the 3rd International Conference on Islamic Fintechs;New Age of Financial Intermediary on 15 Jun. 2019.

Professor Yusuf Ding, a faculty member and one of the middle managers of banking and financial activists in Turkey, said that a new era of banking has begun today with the advancement of technology and the increase in communications, emphasizing the four elements of accessibility, cost-effectiveness, time efficiency and security as the main elements of modern banking.

Professor Ding said that in the future, successful banks will be those whose products and financial services are based on these four principles.

The use of new technologies can facilitate customers' access to banking services (easier marketing of banks), moreover reduces the time and financial costs of banks, and banks will also earn significant income through this. Of course, banking products and services should also be considered cheaper in order to keep the customers due to the reduction of banking costs.

In fact, the bank is nothing more than a basic software and an organizational chart. In modern banking, the bank is available in the desired way. Each person in each part of the world will be a potential customer and the bank access center will also be a website or mobile application, and in the near future, the value of banks will be calculated based on the number of registered users like social media companies.

Banks' competition will be on new banking products and services. In the short term, this competition will be in the field of cost-benefit and product distribution channels and in the long run, new banking will find its main path with changes in exchange currencies.

Increasing transparency in the economic system, quick and easy financial transactions, increasing monopoly in the real sector, eliminating the cost of physical security, paying special attention to cyber security and its risks and many other things will be the effects of modern banking.

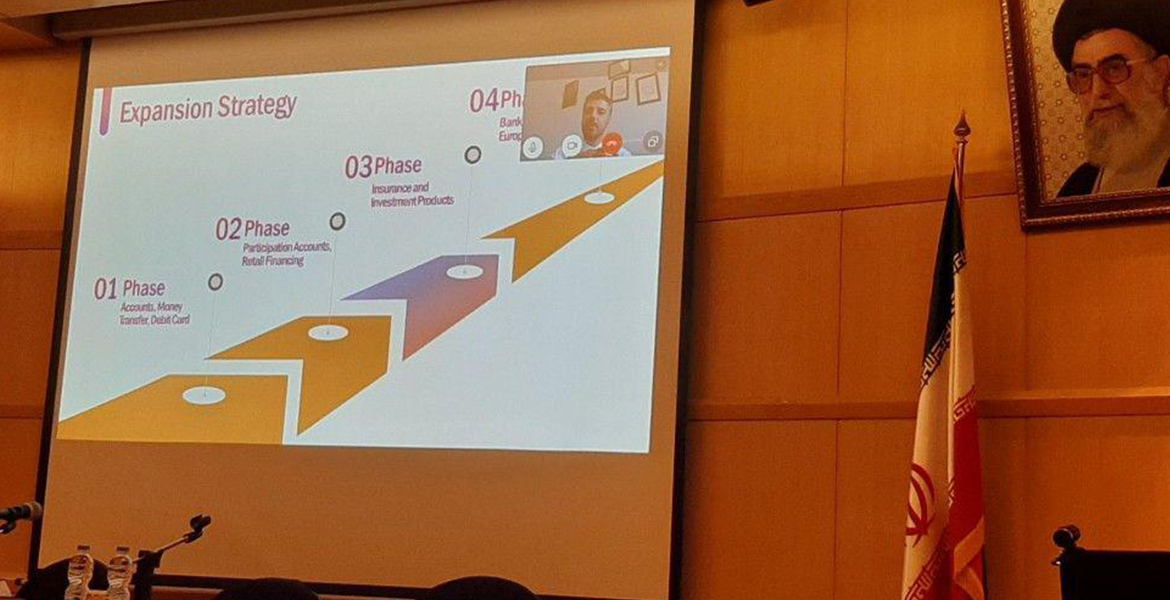

He went on to introduce Insha, the first digital Islamic bank in Europe, saying many Islamic banks claim that their digital banks meet the banking needs of Muslims to some extent, but few of them have made the concept of a complete digital bank in the Islamic world in practice.

Insha Digital Bank (an initiative of Al-Baraka Bank of Turkey) was built on the free banking platform of Solaris Bank Berlin and is the first European-only internet bank to provide Sharia-compliant services to customers in Germany, such as credit card, bank account and money transfer to the countries member of European Union and Turkey.