The methodologies for the product development process of IFIs in secular economies and Fiqh Arbitrage was presented.

Dr. Dinç is a lecturer in Islamic Finance field at “Istanbul Sabahattin Zaim University”. He has several papers and articles in this area.

In his speech at 6th annual conference of Iranian Association of Islamic Finance “Good Governance and its Impact on Financial Market: The Sharia Perspective”, he presented one of his recent studies with regard to methodologies for the product development process of Islamic Financial Institutions (IFIs) in secular economies and Fiqh arbitrage.

He stated that IFRs are increasingly important actors in the financial markets and have had a significant area of research in recent years not only in Islamic countries but in non-Islamic countries such as Europe, USA, Canada, Russia and even African countries.

Meanwhile, Iran is benefiting from a fully Sharia-compliant financial system.

But challenges of developing and implementing new financial products under secular jurisdiction remain an unexamined field.

In his study he tried to answer to the following questions:

1.What can be a possible conversion modeling for IFIs?

2. What can be a possible new product development modeling for IFIs?

3. What is the role of Shariah boards in product development process in IFIs?

Before going to the main presentation, Dr. Dinç added IFIs are somehow enjoying the lack of regulation (Fiqh arbitrage) in secular jurisdiction referring to “Maslahah” .

Then he mentioned there are 2 approaches for countries when they go towards Islamic finance product development, the first approach is increasing the market share like Malaysia and the Persian Gulf countries. The second one is Sharia compliance like Pakistan, Iran, Turkey, Nigeria and Sudan.

There are several studies examining the relation between Sharia compliance and market performance. The results are various from positive correlation to neutral correlation, but it can be totally concluded that development of new Islamic products has a positive relation with Market performance.

In that study, 26 Islamic and conventional banks’ products were examined. Bank Mellat was also one of them.

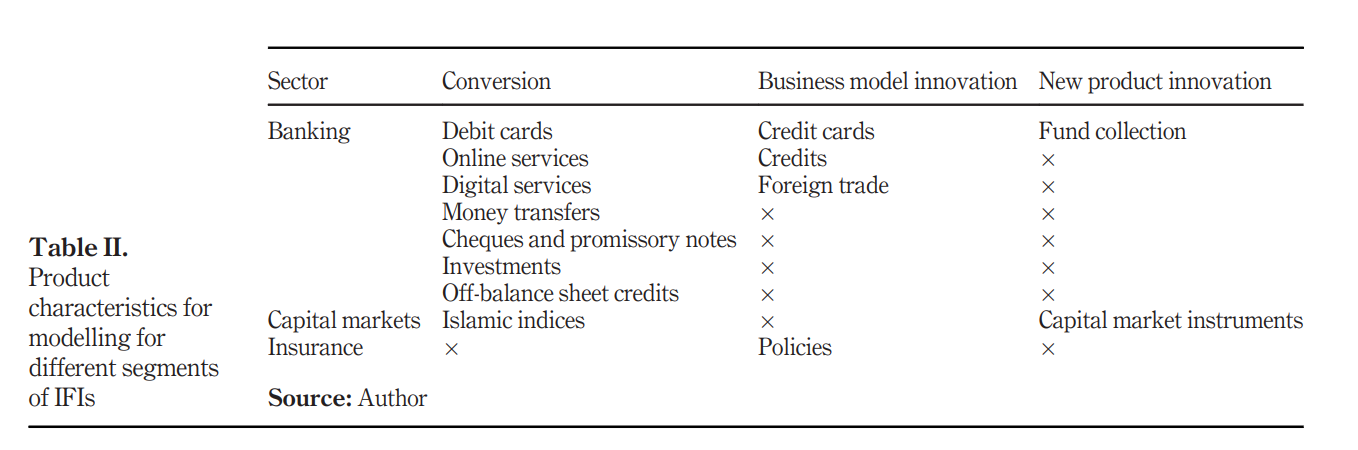

He mentioned there are 3 types of products in IFIs: Converted products such as debit cards, business model innovation such as credit cards, and new products like Sukuks. Then he proposed a model to design new products as follow:

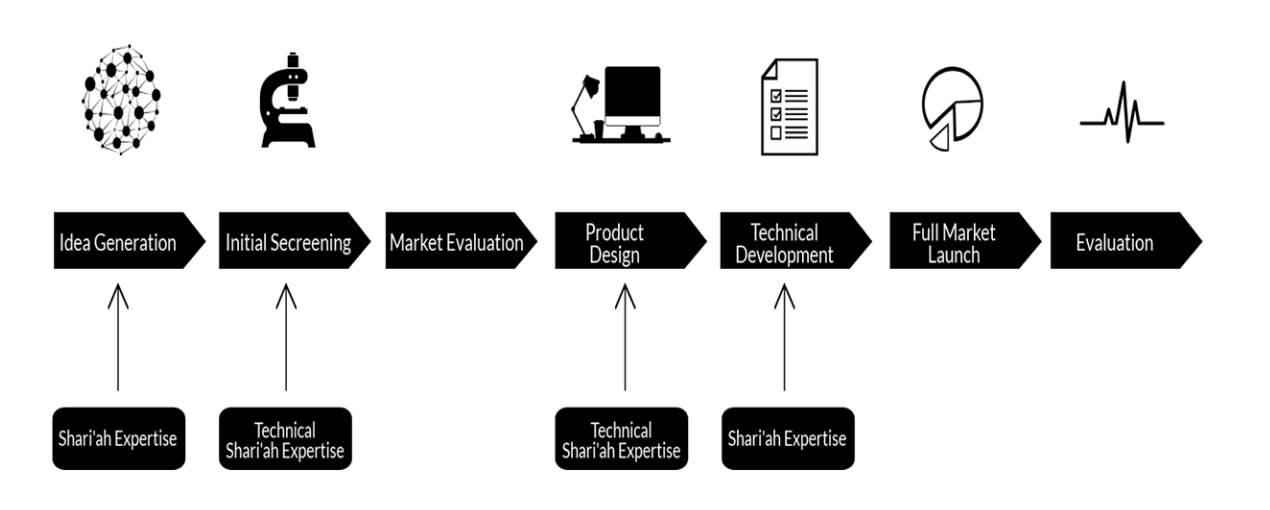

In his model, Dr Dinç emphasized that the critical role of Sharia board in designing new products.

He stated the Sharia board should have responsibility and an operational role in every stage of product development and implementation. He criticized the Sharia board for only advising while they need to get involved in the whole process of a new product development, then he presented the above model.

He concluded IFIs are increasingly important actors in the financial markets and have had a significant area of research in recent years. The introduction of IFIs has triggered a large number of innovative product development researches. IFIs have introduced ourselves as innovative institutions to penetrate the market. The new product development is necessary to gain a competitive advantage. Nevertheless, the conversion of conventional equivalent products is essential to compete in the same platform. For this reason, his study sought to meet the need for two separate models. Noticeably, he suggested the above model can cover the Shari’ah point of view.