IAIF held a webinar on "Islamic Finance Development in Malaysia and Iran" in cooperation with INCEIF and ISRA.

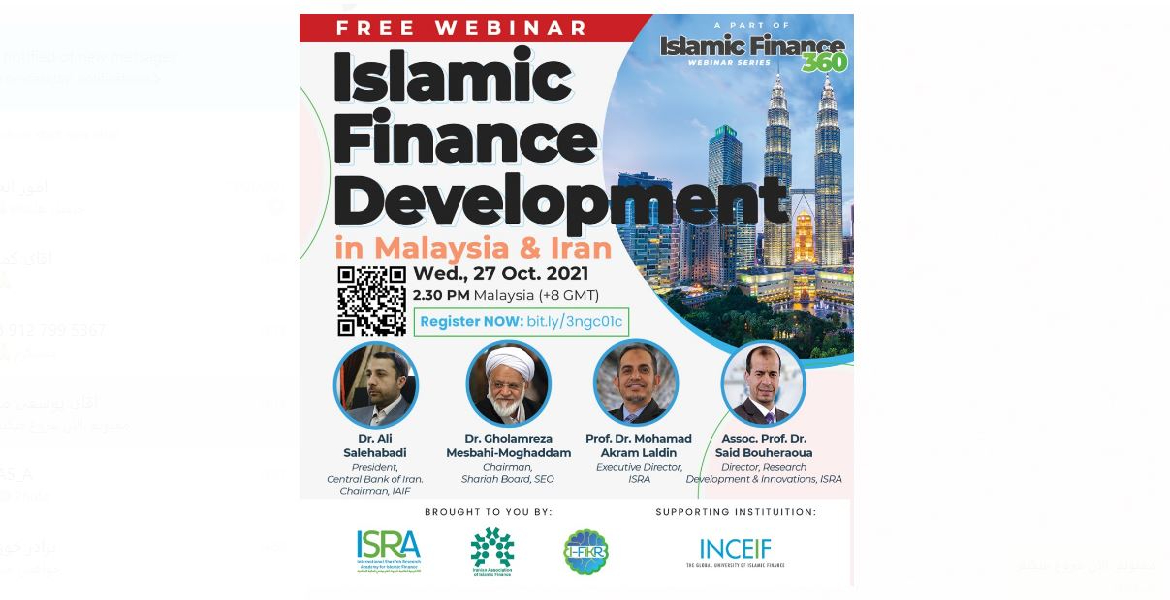

The Iranian Association of Islamic Finance held a webinar on "Islamic Finance Development in Malaysia and Iran" in cooperation with the International Center for Education in Islamic Finance (INCEIF) and the International Shari'ah Research Academy for Islamic Finance (ISRA) on Wed., 27 Oct. 2021.

Lecture by Dr. Ali Salehabadi, Governor of CBI, Chairman of the Iranian Association of Iran

I hope this meeting paves the way for further cooperation among the Iranian Association of Islamic Finance, ISRA Institute and INCIEF University to develop Islamic finance.

ًRegarding the Islamic finance in Iran, after the Islamic revolution in Iran, all laws and procedures fundamentally were revised in compliance with principles of Sharia so that the Constitution of the Islamic Republic of Iran is fully in compliance with principles of Shariah.

Article 4 of the Constitution says all civil, penal, financial, economic, administrative, cultural, military, political and other laws and regulations must be based on Islamic criteria.

Also a part of Article 43 points to the prohibition of infliction of harm and loss upon others, monopoly, hoarding, usury and other illegitimate and evil practices.

Therefore, all laws and regulations, procedures and tools used in Iran’s financial markets are implemented after review and compliance with Sharia laws.

Regulatory institutions in Iran's financial markets include the Central Bank in the money market, the Central Insurance in the insurance market and the Securities and Exchange Organization in the capital market.

Capital Market

The supervisor and regulator of the capital market in our country is the Securities and Exchange Organization, which is under the supervision of the Supreme Council of the Exchange.

The scope of activities of the Exchange organization includes issuers, financial institutions and self-regulatory organizations.

Self-regulatory organizations also include quadruple exchanges, associations and central depository companies.

The four exchanges in our country include Tehran Stock Exchange, Fara Bourse exchange, Iran Mercantile Exchange and Energy Exchange, in which different instruments are exchanged in accordance with each one’s activity.

In Tehran Stock Exchange, stocks, pre-emptive rights, stock futures and Musharakah sukuk are exchanged.

In Fara Bourse exchange, Musharakah sukuk, Ijarah sukuk and Murabaha sukuk are traded.

In Iran Mercantile Exchange, futures contracts, Salam and standard parallel Salam contracts, futures and options contracts are traded.

Standard parallel Salam, futures and option contracts are among the instruments used in the Energy Exchange.

As it was mentioned before, all these institutions and instruments have to operate in compliance with the principles and laws of Sharia.

The Shariah board of the Exchange Organization examines the compatibility of laws, regulations, instruments and institutions active in the capital market with the principles of Sharia.

The board consists of 8 members, including 5 jurists, a financial expert, one economist and one legal expert.

As a result of the actions of the Shariah board of the Securities and Exchange Organization, various Islamic financial instruments and institutions have been established. Among the instruments, we can mention Musharakah,Ijarah,Istisna and Qard al Hassan sukuks.

For example, the value of outstanding Sukuk issued in Iran capital market is currently more than 4 million billion IRR.

Also, among the latest measures and innovations in Iran capital market, we can mention the creation of a crowdfunding market, the issuance of Corona charitable securitiess, the launch of the Sukuk index and the issuance of Sukuk without a guarantor and based on credit rating.

So far, a summary of the situation of the Islamic capital market of Iran has been presented.

In the banking sector, the first step to comply with Sharia was passing the interest-free banking law in 1983.

By passing time and the necessity of strengthening Shariah supervision in the banking system, The Shariah Council of the Central Bank found a legal status in accordance with the law of sixth five-year plan for the development of the Islamic of Iran.

Currently, the interest-free banking law is under examination in Iran’s Islamic Parliament.

At present, in our country there are 8 government-owned banks, 17 private banks, 2 Qard al Hassan banks and one bi-national bank under the supervision of the Central Bank.

The Shariah council of the Central Bank examines the compatibility of laws, regulations, tools and institutions active in the banking system with the principles of Sharia.

The council consists of ten people, including the governor of the Central Bank, five jurists, an economist, a lawyer, a CEO of bank (representing the CEOs of banks) and a member of the Islamic Parliament as a supervisor.

The most important differences between Islamic banking in Iran and other countries are the following:

1. The Iranian Shariah-compliant banking model is conducted in a countrywide system in more than 24,000 banking branches with no room for conventional banks. Hence, it differs from other Islamic countries (like Malaysia) where the dual banking system is in practice.

2. The Islamic banking model of Iran is backed by an independent Act that was ratified in 1983 and enforced ever since. Such a reference Act is absent in most other Islamic countries.

3. One single Shariah board in the Central Bank of Iran serves the entire banking system, whereas, in other Islamic countries, each bank has its board.

4. Approximately 6,000 private Gharzolhasaneh funds in the Iranian financial market, founded by benevolent people, offer across an extensive social network small Riba-Free loans to those in need. Other Islamic countries lack such institutions.

5. In Iran, Sukuk is used for monetary policy as well as the financing of both public and private sector needs. The majority of other Islamic countries (except Sudan), however, use this instrument only for project financing.

6. Islamic accounting and auditing standards are not commonly practiced across the whole Iranian system and only Basel standards are observed. In contrast, in other Islamic countries, AAOIFI standards are being practiced in a way different from conventional models.

Considering this event which has been organized by three scientific groups: INCIEF University, ISRA Institute and the Iranian Association of Islamic Finance, it is good to mention some actions of the Iranian Association of Islamic Finance in order to develop Islamic finance.

Creating a specialized Islamic finance website

Holding MBA and DBA courses in the Islamic capital market jointly with Imam Sadiq University and the Securities and Exchange Organization and international institutions (more than 150 students)

Defining Islamic financial awards (top person, top institution, top book, top thesis and dissertation)

Issuing books, scientific research journals and publications in the field of Islamic finance.

Compiling jurisprudential fatwas, classifying and publishing them on the website of the Association, which will be published in the English part of the site soon.

At the end, I would like to thank the organizers of this event once again and hope that in the near future we will see the development of scientific and executive cooperation in the field of Islamic finance.

Dr. Gholamreza Mesbahi Moghadam,Chairman of SEO's Shariah board

At first he talked about the history of Shariah board established in Iran capital market in 2005 along with Dr. Ali Salehabadi. It was the first time that Shariah board entered. The shariah board has been working more than 15 years to develop financial instruments based on Shariah principles.

One of the issues which was ratified in the Shariah board was Ijarah suck based on stocks or shares of the companies. Those Companies have non-financial assets such as buildings and real estate can issue Ijarah suck based on real assets not financial assets. They can also offer them in the capital market and investors invest on them. It has happened for the first time in Iran and the world.

In the past there were some Ijarah suck based on hotels, airplanes and other assets which were not based on real assets of the companies. In the new form of Ijarah suck, investors after one, two or three years at maturity can redeem them. It means the investors can sell them and the other sides buy them, so it is very attractive for investors in Iran capital market.

Dr. Mesbahi Moghdam said so far more than one hundred companies in Iran have sent their requests for issuing Ijarah sukuk which is more than thousands of billion Iranian Rials which have been financed in this way.

These companies have done their finance through sukuk in the capital market not through the banks. If a company sends its request to the Securities and Exchange Organization (SEO) for issuing this kind of sukuk, the shariah board checks the requests case by case, namely the nature of a company, its activity, assets, balance sheet etc. to know a company is qualified to issue Ijarah sukuk or not.

One of the requirements is that the 60% of a company’s assets must be fixed and real assets and it must not be financial assets. Furthermore, these assets must have the capability of Ijarah or being leased. Some companies also have sent their requests two times. They have done their finance through Ijarah sukuk, of course there is ceiling for financing.

Through the Ijarah sukuk, companies cannot sell or transfer there ownership of those stocks despited they have been used for Ijarah sukuk because the ownership of stocks belongs to the investors of the Ijarah sukuk. Investors also can sell them in the secondary market.

Regarding the shariah board in Iran’s money market it has been working for many years and the status of the shariah board has been approved by the Parliament, so every act, ratification and decision which is made by the shariah board of money market is mandatory for all banks and financial institutions of Iran. The banks have to obey all theses decisions.

One of the latest decisions made by the board was issuing a kind of sukuk for collecting real assets of people by the banks. This decision is to help economy to have both contractual and expandable abilities in accordance with various situations. The redemption can be 3 months or more. Hence the value of people’s assets is kept and they are not depreciated in value by inflation.

At the end he talked about different kinds of financial instruments in the capital market and money market such as repo but Islamic repo for factoring debts.

Beforee the Islamic revolution we had three bills: treasury bill, treasury note and treasury bonds based on interest, so they had a problem in terms of shariah but after the revolution they were not allowed anymore because they were not in compliance with shariah principles so we made Islamic treasury bills, bonds and notes. Therefor shariah boards in both SEO and Central Bank have worked very hard on Iran financial market to ensure people all instruments are in compliance with the principles of shariah.

Lecture by Dr. Mohammad Akram Laldin, ISRA's Executive Director

At first he said Malaysia continues to be a prominent global Islamic Capital Market (ICM) hub, with Islamic assets under management growing 2.7 times. Additionally, Shariah-compliant assets amounted to RM 2.3 trillion as of the end of 2020. Having grown from RM 1.1 trillion in 2020.

Dr. Laldin stated that Malaysia also recorded the largest market share of global suck issuance in 2020 at 3.9%. Presently, ICM accounts for more than 60% of the Malaysian capital market.

“Overall, the global suck issuance increased by 16.8% to USD 152.6 billion in 2020, compared to USD 130.6 billion in 2019” the speaker said.

Regarding the global Islamic finance industry landscape, he mentioned that at the end of 2024, global size of the Islamic financial service industry is forecast to reach $ 3693 billion.

Dr. Laldin pointed to the growth of Islamic finance service industry, going on to say that according to IFSB (2020), the total growth of the IFSI increased to an estimated USD 2.44 trillion in 2019 (from USD 2.19 trillion in 2018). The IFSI sustained its growth momentum in 2019, recording a growth rate of 11.4% year on year based on significant improvement across the three segments of the IFSI, especially Islamic banking and ICM. However, Islamic finance industry continued to grow slowly in 2020. This is due to the significant volatility in global oil price and production as well as Covid-19 pandemic.

Somewhere else the speaker stated that the Islamic banking industry in Malaysia, sustained its growth, albeit modestly, in the third quarter of 2019. The industry now captures 28.4% of the Malaysian commercial banking system.

As to sovereign suck in the world, he said in the global market, Indonesia is considered as the world’s largest international sovereign sukuk issuers with total outstanding amounted USD 18.15 billion. Then, followed by global sovereign suck of Saudi Arabia ($13 billion), Emirates of Dubai ($ 8.2 billion), Malaysian Government ($ 7 billion) and Turkish Government ($ 6.25 billion).

The speaker mentioned that in Malaysia, the suck market provides customized solutions to government and corporate issuers through a variety of sukuk structures using different Islamic contracts such as Murabaha, Wakalah, Mudharabah, Musharakah or hybrid structures based on combinations of Shariah contracts.

Regarding the green sukuk issuance, he said the issuance of green suck is expected to accelerate in the coming years as part of efforts to combat climate change and to meet sustainable development goals in the national and international agenda. Malaysia and Indonesia have been the main pioneers of green suck issuances. Furthermore, the Islamic Development Bank with total green sukuk issuances in 2019 exceeding USD 3 billion.

Dr. Laldin said Covid-19 accelerates shift to digital transaction and mobile banking transaction value in Malaysia in 2020 grew 125% and stood at approximately 450 MYR billion.

Somewhere else he stressed that Shariah governance is in the whole operations of IFI’s: moreover, Shariah governance is not only under Shariah board responsibility, but the whole stakeholders in IFI’s industry.

At the end, Dr. Laldin said in Malaysia codification of duty on Islamic financial institutions to ensure its aims, operations, business, affairs and activities are in compliance with Shariah at all time.

Lecture by Dr. Said Bouheraoua, Director of ISRA's Research Development & Innovations

In the beginning of his lecture, he said the most important milestones of Islamic finance in Malaysia are as follows:

1- 1965: The Islamic Savings Institution is established.

2- 1983: the Islamic Banking Act is passed.

3- 1983: the first Islamic bank. Bank Islam Malaysia, is established. A 10-year freeze was put in place preventing the opening of any other full-fledged Islamic bank, or even any Islamic window, in order to give Bank Islam a chance to succeed.

4- 1984: The Takaful ( Islamic or cooperative issuance) Act is passed and the first takaful company, Takaful Malaysia, is established.

5- 1990: the first sukuk is issued, based on a deferred-payment sale structure, by Shell Corporation.

6- 1993: Conventional banks are allowed to open Islamic widows.

Then the speaker stated Islamic finance players in Malaysia are Islamic banks& takaful companies, Islamic capital market and Islamic money market. He added, in Malaysia’s capital market 57% of private debt is in sukuk, 88% of the transactions in the Kuala Lumpur Stock Exchange is in compliance with Shariah.

Regarding the factors of the success of Islamic banking in Malaysia, Dr. Bouherao stated they are as follows:

First: The adoption and support of Islamic banking by the Malaysia government

Second: Clear vision and strategic planning: BNM to release the 5-year plan for Financial Sector in 2022

.

Third: A clear legal framework: a comprehensive framework for Islamic banking activities was laid down in the Islamic Banking Act of 1983/2009 and the Takaful Act of 1984/2005. Moreover, guidelines have been issued for a number of financial products.

Fourth: The attention paid to developing human capital: establishing a scientific and progressive society; innovative and forward-looking, one that is not only a consumer of technology but also a contributor to the scientific and technological civilization of the future.

Fifth: The strength of the infrastructue. Infrastructure consists of material and organizational structures.

Somewhere else he mentioned that physical risk, transaction risk and liability risk impact on financial system leading to credit&insurance/protection loss, financial market loss and feedback loss.

At the end, Dr. Bouherao said to achieve the success of Islamic banking in this country, Malaysia in 1984 (among other steps) set up the International Islamic University, which, in turn, set up the Institute of Islamic Banking and Finance as well as Islamic finance divisions in the Department of Economics and Law. In 2005 Malaysia’s central bank (BNM) established the International Center for Education in Islamic Finance (INCEIF).

Moderator

Dr. Farhad Morsali, Head of the International Committee of the Iranian Association of Islamic Finance, was the mediator as well as an interpreter in this webinar.